Economic Stories of Relevance includes two very significant interviews. One interview is with Dr. Paul Craig Roberts relating to the current state of the economy and the fraudulent numbers that have been put out by the government. The second interview is with Andrew Huszar, who is a former Federal Reserve Member & former Managing Director at Morgan Stanley. He helped to create the initial Quantitative Easing program. He talks about the dark days of September 2008 when the banks were literally insolvent. If you want an eye opening experience, then you should listen to these two interviews. You really need to study these two interviews. These gentleman know what has happened, is happening, and what most likely is going to happen in the future.

Andrew Huszar - King World news Interview - August 3, 2014 - Former Fed Member & Former Managing Dir. At Morgan Stanley - Until June, 2012, Andrew was Managing Director and U.S. Head of OTC Derivatives Client Clearing for Morgan Stanley. In this role, Andrew reorganized and managed a business encompassing sales, financial planning and analysis, product development, on-boarding, and client service functions. Previously, Andrew managed for the Federal Reserve Bank of New York ("FRBNY") the $1.25 Trillion Agency MBS Purchase Program (the centerpiece of "QE1"). In this role, Andrew managed the program's portfolio design and trading strategy, as well as the creation of a permanent, in-house Federal Reserve MBS business platform, encompassing front, middle and back office components. By way of additional professional background, Andrew was previously a Senior Vice President at RBS Greenwich Capital and co-head of the Transaction Advisory Group, specializing in the Basel II Capital Rules. Prior to RBS, he was an Examining Officer in the FRBNY's Bank Supervision Group, leading a Market and Liquidity analytics team assessing financial risk exposures of large U.S. financial institutions. Andrew began his career at the FRBNY as a lawyer supporting various business lines.

King World News Audio Interview

He was responsible for QE1 to access emergency funds. Had left the Fed in early '08 was on Wall Street. 2008 were harry days. Every U.S. bank after Lehman were done. They couldn't fund their operations. Fed was under the gun. This has clouded their judgment. Standards were changing by the minute - fitting square pegs into round holes - No cash they were done.

The Fed has done extraordinary moves over the past 5 years. Balance sheet has grown from $800 billion to $4.4 trillion. Major issues with the Fed going forward are internal. Fed has printed a lot of money. It is a the banks (liquidity). Instability can be created by trying to use unprecedented tools to reel that money back in. The Fed owns 30% of the Federal Governments debt and 15% of the U.S. housing market. This instability can lead to a loss of confidence in the dollar and lead to inflation. The leverage that created the crisis in 2008 is still there, but instead of being with the banks, it is now at the Fed.

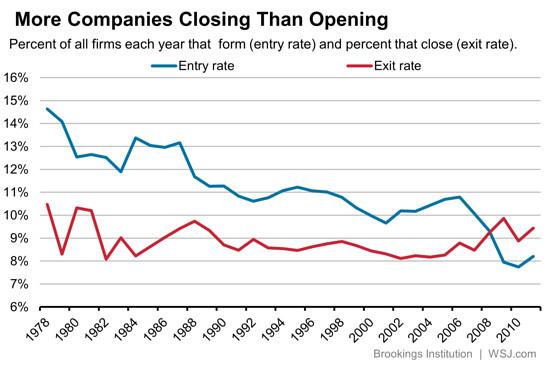

We are in line for tough times in the financial markets. Federal Government money has been pumped into the stock market and this is going to come to an end. The last 5 years have been a missed opportunity. 2008 revealed an overly financialized U.S. economy. Banks are 16x more concentrated than in 2008. We haven't built and developed human and physical capital. Individuals grew 2 1/2 times more indebted from 1998 to 2008. Credit bubble has popped. Main street is not thriving. Last five years have been the Fed pumping money into the economy when there has been gridlock in Washington and a lack of structural reform, What we see not is that the can has been kicked down the road and the problems from 2008 still exist.

Our economy is 5th in the world terms of competitiveness and in 2008 we were 1st. We are addicted to easy Money. There has been no change in Wall Street... denial and no accountability. Up to the late 90s, 90% of JP Morgan's portfolio were loans, now it is 60% and the rest is derivatives. Wall Street is not properly pricing risks. Six big banks are at the center of the system. Money printing can't go on forever. We aren't making investments in human and physical capital. We need to confront reality.

Paul Craig Roberts - King World News Interview - August 2, 2014 - From early 1981 to January 1982 he served as Assistant Secretary of the Treasury for Economic Policy. President Ronald Reagan and Treasury Secretary Donald Regan credited him with a major role in the Economic Recovery Tax Act of 1981, and he was awarded the Treasury Department's Meritorious Service Award for "outstanding contributions to the formulation of United States economic policy."

King World News Audio Interview

4% growth number in the GDP, released last week, is a hoax. Nothing that has happened in the economy that would cause such a strong turnaround. What the number reflects is unintended growth in inventory. What would support such a strong performance.

Discount stores are hurting. Dollar Tree buying Family Dollar. Low income (poor people) stores can't continue. Middle class stores have already been hurting. Stock Market perceived to be doing well because of prices/indexes. Corporations are single largest buying source for U.S. stocks 9buy backs). 2006-2013 corporations authorized 44.1 trillion worth of stock. Corporations are borrowing money from banks for these buybacks to drive up the stock price to obtain bonuses based on stock price.

Manufacturing coming back to the U.S. is a hoax. In the first 12 years of this century, the imports of offshored manufacturing has grown by 9%. The inflation adjusted net worth of the U.S. household in 2003 was $88,000. In 2013, it is $56,000... a 36% decline in wealth. If inflation were correctly measured, then we would see that there has been no recovery since 2008. Internationally, countries are ceasing to use the dollar for trade. All of this is putting downward pressure on the dollar. Will have devastating effects on trade.

If the Fed's money had gotten into the economy, then we would have see hyperinflation. Banks are too broke to lend. Consumers are too broke to borrow. QE purpose only supported the banks balance sheets. No corrective action has been taken. Fed buying derivatives has risen their price to support the banks' balance sheets. Eventually something will break and this will lead to a crisis. The currect situation isn't tenable.

Dollar is a cooked currency. Imports will become more expensive. Consumers will be pushed further to the wall. This will lead to massive social instability. People will starve. Banks control the Fed, the Treasury, and regulatory agencies. The Financial system has protected the banks by creating a bigger crisis for the future. We have never seen this before.

War on Gold continues. Price is fixed in the futures market. Manipulating price. Daily attacks with naked shorts. Asians are gobbling up physical. What happens when fiat currencies crash? You won't be able to purchase.

Things continue to worsen. GDP falls in the first quarter, but Stock prices rise. Bonds are at negative real interest rates. Dr. Roberts is surprised how long this has gone on. None of this makes sense. Would never have happened at any point in time in past history. Derivatives can't be covered -- several multiples above world GDP. What you see is insanity. No accountability. Have not corrected issues of deregulation that caused the crisis. Complete and total failure of the U.S. government. What will happen? He doesn't know, but we are going to find out.

David Stockman: The Collapse of the American Imperium - A perfect storm of policy failures - Adam Taggart - August 3, 2014 - David Stockman, former director of the OMB under President Reagan, former US Representative, best-selling author of The Great Deformation, and veteran financier is an insider's insider. Few people understand the ways in which Washington DC, The Fed, and Wall Street work and intersect better than he does. He's extremely concerned by the "perfect storm" he sees of concurrent failures in US policy across foreign, monetary, economic, and fiscal fronts:

If you look at the entire radar screen of things developing both domestically and internationally, we are plunging deep into a perfect storm of policy failure. The American Impirium is collapsing. There is blowback everywhere. The wreckage of prior policy mistakes of our intervention with foreign policy is coming home to roost, and the Ukraine is one area at ground zero for that. But second, monetary central planning is now coming to a dead-end. It is inflating the third financial bubble of the century and the Fed is now clueless as to how it will manage to unwind the massive balance sheet expansion it has been undertaken. And third, the fiscal doomsday machine continues to crank on. Washington is ignoring the fact that we are six years into a business cycle expansion and we are still running massive deficits and there is no cushion for the next upset that comes to the economy. Now, why is all of this important? Because I think the foreign policy failures -- the collapse of the American Impirium as I call it -- is at the center of this, and it will push all of these things in the wrong direction. We are now becoming much more aggressive in our foreign policy than ever before. We can't afford it by any means. And the potential for this to create black swans to roil or dislocate these very fragile markets that have been created by this massive central bank balance sheet expansion -- it all makes what is happening in the Ukraine, or in the Middle East in Gaza, or in the collapse of Iraq, even more dangerous in terms of what it could trigger. So we are in a real pickle here and I think it is compounding by the day...