Congress’s Absurd Insider Trading Bill - 24/7 Wall St.com - Douglas A. McIntyre - February 3, 2012 - This has been said before, but it is worth saying again. The idea that Congress needs to pass a bill to keep members of Congress and their staffs from insider trading is the reason Americans have no confidence in the institution. It is tantamount to passing a bill that says members of Congress cannot sell illegal drugs on the floor of the House or Senate. Congress members and their staffs know better, too. They receive mounds of information about decisions and data that could affect the values of public companies. The rule, even if it is not put down in law for them to follow, is that if you can make money that people without the information cannot, it is illegal and unethical. And it is also one of the roots of the national confidence in the federal legislative institutions.

Unemployed College Graduates As Vulnerable As High School Dropouts To Long-Term Unemployment: Report - Huffington Post - Bonnie Cavoussi - February 2, 2012 - College graduates and advanced degree holders, once they are unemployed, are as vulnerable as high school dropouts to long-term joblessness, a new study has found. Thirty five percent of unemployed college graduates and those with advanced degrees have been without a job for more than a year, the same rate as unemployed high school dropouts, according to a Pew Fiscal Analysis Initiative study published Wednesday. In fact, the long-term unemployment rate, for those 25 and older without a job, is nearly the same across all levels of educational attainment, the report says..... The long-term unemployed also often face job discrimination, as many employers prefer to hire workers with fresh experience. A number of employers require job applicants to be "currently employed" in order to be considered for a position.

Long-Term Unemployment Remains High, Millions Leave Labor Force - CNSNews.com through the Blog The Destructionist - Matt Cover - February 3, 2012 - Despite a January jobs report that saw slightly stronger private sector job growth than in recent months, long-term unemployment remains at record high levels and revised statistics show that another 1.2 million [in just one month] have left the labor force. According to the Bureau of Labor Statistics (BLS), the number of long-term unemployed – those out of work for 27 weeks or more, was unchanged at 5.5 million in January, near its record of 6.7 million in April 2010. That number has been at historic highs of 5-6 million since August 2009. BLS figures also reveal that the number of people who have left the labor force entirely was much higher than previously thought – 1.2 million higher.

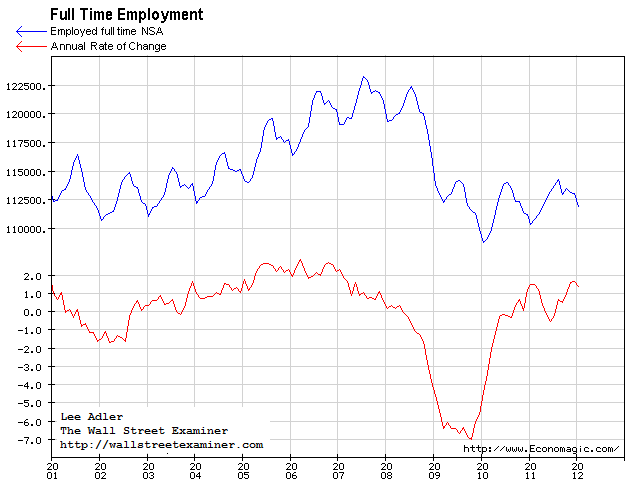

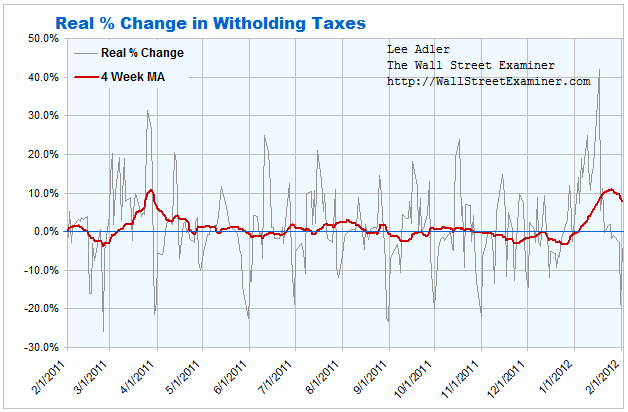

Deconstructing The “Massive Beat” in Employment Data- Corrected - The Wall Street Examiner - Lee Adler - February 3, 2012 - I like to look behind the headlines at the real unadjusted, unmassaged, unmanipulated numbers to get some idea of what’s really going on. Here’s where things get strange. Total reported employment and full time employment plunged in January, as is normal for that month. So the Gummit survey data doesn’t square with the tax collections. Had we based our forecast for the headlines (which is the only thing that matters to the market in the short run) on the withholding data, we would have gotten it right, but for the wrong reasons. It’s a head scratcher that suggests that the Gummit’s employment numbers shouldn’t be trusted, which isn’t news. What we do know for sure is that there was a gigantic surge in withholding taxes from late December to mid January, and that surge disappeared completely in the last week...... Meanwhile, the government’s own survey data show that 7.4 million fewer people have full time jobs today than was the case 4 years ago. Those 7 million jobs were the fake jobs spawned by the housing and credit bubbles. Those jobs were vaporized when the bubble economy collapsed. They are NEVER coming back. The “new normal” is just the old normal without the added froth. What we are left with is the bitter reality of fewer people carrying the tax load and more people needing government assistance. We have yet to see any real proof that the trends are improving enough to ameliorate those burdens on the economy.

House prices hit post-bubble low - Washington Post - Peter Whoriskey - January 31, 2012 - Data released Tuesday showed that seasonally adjusted housing prices have reached a post-bubble low, as the minor surge that began in 2009 fizzled, to be followed by the almost continuous slide of the past 18 months. The housing bust, in other words, appears to be even worse than it was at the nadir of the recession. For millions of homeowners, that’s an unsettling reality, and potentially an issue in the presidential campaign. But the damage may be far more widespread........

“The trend is down and there are few, if any, signs in the numbers that a turning point is close at hand,” said David M. Blitzer of S&P Indices. “I spent the weekend scratching my head and saying, ‘Isn’t there some good number in here?’ ” The Standard & Poor’s Case-Shiller seasonally adjusted housing index for 20 cities dropped again in November, the last month for which data were available, falling to a level not seen since 2003....... “Housing starts have been at 60-year lows for 38 months — it’s incredible,” said Karl E. Case, emeritus professor of economics at Wellesley College and co-founder of the housing price index. “It’s a complete depression.” Case noted, for example, the slump’s profound effect on the residential construction industry: Annual housing starts in the United States peaked at 2.37 million and have fallen to fewer than 700,000. “Eighty percent of a major industry in the United States just disappeared,” he said.... The recent white paper from the Fed noted, for example, that housing prices have fallen an average of about 33 percent from their peak, erasing $7 trillion in household wealth. With that, according to the paper, comes a “ratcheting down” of what people buy.

Bank of America Would Spare Only Two Headquarters in Plan to Sell Offices - Bloomberg - Hugh Son - February 3, 2012 - Bank of America Corp., the second- largest U.S. lender by assets, may sell all its offices as part of the company’s effort to cut costs, sparing only its headquarters in North Carolina and New York City. “We are currently reviewing all of our properties across our portfolio, with the exception of Bank of America Corporate Center in Charlotte and Bank of America Tower at One Bryant Park” in Manhattan, Kelli Raulerson, a spokeswoman, said today. The lender owned or leased about 120 million square feet in 26,910 locations at the end of 2010, mostly in the U.S., according to its last annual report. Chief Executive Officer Brian T. Moynihan, 52, is reevaluating the bank’s real estate needs as he eliminates at least 30,000 positions and seeks to trim as much as $8 billion in annual expenses. If Bank of America sells buildings, it will lease back space for operations, avoiding impact on employees, the company said in a statement provided by Raulerson.

How US Fascism Comes Out on Top Via 'Too-Big-to-Fail'? - The Daily Bell - Thursday, February 02, 2012 - Too-big-to-fail legislation is toxic on every level. It marries government to private industry, drains competition from the marketplace and ensures that the most important elements of the modern financial system are further constrained by regulatory fiat. Of course, one could argue that the modern system – one that has been built on the monetary fraud of central banking – is not worth saving anyway. We would agree with that, in fact. The current financial system not only deserves to collapse, it DID collapse three years ago. The dollar reserve system, from our point of view, is already dead. From what we can tell, central banks – at the behest of their controlling power elite – have injected some US$50 TRILLION into the system worldwide. These horrible numbers are actually incomprehensible. The larger financial system is effectively frozen. It has not been allowed to shed its failing elements, and one could argue, in fact, that these failing facilities have been enshrined at the heart of the system's decisive economic dysfunction. In other words, the very entities that are the most important to the system's current operation are the ones that should be allowed to fail. They exist only because the system – worldwide – is a kind of elite command-and-control operation that has little or nothing to do with free markets. But as the current central banking system becomes more and more dysfunctional, the costs of keeping it going are rising exponentially. As we have pointed out, the current environment has a manifest logic, and it's not a pleasant one. There is no economic justification for "too-big-to-fail" except the brutal logic that government funds must compensate for private failures. This will work for a while, but not forever. Eventually, the dysfunction will be too big even for governments' large pockets. In the meantime, we will have "isms" – specifically, growing fascism in the US. Europe, we would argue, is headed in the same direction. Remove competition from the marketplace and you end up with a collection of enterprises that perform inconsequential functions incompetently. More importantly, you end up with a federalized private sector and a series of disastrous "public-private" partnerships. The result is ruin – ruin of every kind. Militarism thrives in a fascist environment. So does a certain kind of ignorance, civic dysfunction and increasingly poverty and civil violence. Chaos looms. Of course, out of chaos ... order. A New World Order. That's obviously the plan. But as we often point out, we would tend to believe that what we call the Internet Reformation will make the elite's main dream rather hard to achieve. The more that the powers-that-be plot to increase the dysfunction of the Western world and especially America, the more push back is generated, in our view. It may turn out that ordinary people in the Internet era are far more resistant to fascism – statism – than elites currently believe. Conclusion: Will the world-spanning plans of the Anglosphere be realized? Just as too-big-too-fail is ultimately an insupportable concept, so is the idea of world government. They are both based on enormous economic fallacies and carry within their implementation the seeds of their own destruction.

Usury - I personally have problems with Bill Mahers personality, but this is a good interview thanks to Elizabeth Warren. Yeah I know, she's a Democrat, but what she says here makes sense.

1 comment:

Wasn't Rome too big to fail? Just wondering? Sincerely, Charlemagne

Post a Comment