Since the City of Hickory has chosen to delete the Video Recording they have uploaded to Youtube, I will be uploading and archiving the old meetings to the Hickory Hound Youtube Channel and linking them here on the Hickory Hound as they delete them. This is done for your reference.

There are archives of other past meetings at the Hickory Hound website - http://thehickoryhound.blogspot.com/

And there are other various videos at our Youtube page - http://www.youtube.com/user/hickoryhound

September 17, 2013 -

September 3, 2013 - http://youtu.be/7u05_GlF798

August 20, 2013 - http://youtu.be/B-RRK9yAflg

August 6, 2013 - http://youtu.be/6FIckkrxVGQ

July 16,2013 - http://youtu.be/BOCUofjzxtk

June 18, 2013 - http://youtu.be/vDlC5IdlB-4

June 4, 2013 - http://youtu.be/vAyKsUqWTzY

|

|

| Join To Get Blog Update Notices |

| Visit the Hickory Hound Group |

Thursday, June 27, 2013

Sunday, June 23, 2013

Economic Stories of Relevance in Today's World -- June 23, 2013

The Rational Market Myth — Paul Craig Roberts - June 20, 2013 - One of the myths of economics is that markets are rational. Theories are based on this assumption, and the belief that markets are rational fuels the argument against regulation. The market response to the Federal Reserve’s June 19 statement that it will taper off its bond purchases if its forecast comes true is unequivocal proof that markets are irrational. The Federal Reserve’s statement that it “currently anticipates that it would be appropriate to moderate the monthly pace of purchases [of bonds] later this year” depends on a very big if. The if is the correctness of the Fed’s forecast of moderate economic growth and employment gains. The Fed has not stopped purchasing $85 billion of bonds each month. So nothing real has changed. Indeed, there was no new information in the Fed’s statement. It has been known for some time that, according to the Fed, its bond purchases will gradually cease. In response to this repeat of old information, the stock and bond markets sold off in a major way on June 19-20. This market response to the Fed’s statement indicates that the Fed’s forecast is unlikely to come true. Low interest rates and a high stock market are totally dependent on the liquidity that the Fed is injecting by printing $1,000 billion per year. If this liquidity is not injected, what will sustain the markets? If the markets crash and interest rates rise, how can the Fed expect recovery? In other words, the participants in the stock and bond markets know that the markets are bubbles created by the printing press. There is no real basis for the high stock and bond prices. The prices are an artificial reality created by the printing press. Rational markets would take into account the printing press element and would price stocks and bonds at a much lower level. Zero real interest rates mean that there are no risks. But how can there be no risk in Treasury bonds when the debt is growing faster than the economy? Normally, high stock values mean strong profits from strong consumer income growth and retail sales. But we know that there is no growth in real median family income and real retail sales. I suspect that the reason the Fed made the announcement, which seems to be derailing the Fed’s forecast of recovery on which the announcement depends, is to relieve pressure on the US dollar. For several years the Fed has been printing 1,000 billion new dollars each year. There is no demand for these dollars. So far these dollars have inflated stock and bond prices instead of consumer prices. But the implication for the dollar’s price or exchange value in currency markets is clear. The supply is increasing faster than the demand. If the dollar falters, the Fed would lose control. Rising import prices would soon drive domestic inflation and interest rates far higher than the Fed’s targets. Washington has succeeded in getting Japan and the EU to print yen and euros in order to eliminate the likelihood of flight to other large currency alternatives to the dollar. Smaller countries have also had to print in order to protect their export markets. With so many countries printing money, the Fed’s statement implying that the US might stop printing makes the dollar look good, and, indeed, the dollar rose on the currency exchange markets. Having neutralized the alternative currency threat to the dollar, the Fed and its agents, the bullion banks, the banks too big to fail, are still at work against the gold and silver threats to the dollar. Massive short selling of gold began at the beginning of April. Again on June 20 massive shorts of gold were sold at a time of day chosen to maximize the price decline. Only those who intend to drive down the price would sell in this way. Since QE began, the Fed has deprived retirees of interest income and has forced retirees to spend down their capital in order to pay living expenses. Judging from the initial market response, the Fed’s latest policy announcement is adversely impacting bond, stock and real estate investors, and the manipulation of the bullion markets continues to wreak destruction on wealth stored in the only known safe haven. How can a recovery happen when the Fed is destroying wealth?.....

“If The Yield Goes Significantly Higher The Market Is Going To Freak Out” - The Economic Collapse Blog - Michael - June 21st, 2013 - If yields on U.S. Treasury bonds keep rising, things are going to get very messy. As I write this, the yield on 10 year U.S. Treasures has risen to 2.51 percent. If that keeps going up, it is going to be like a mile wide lawnmower blade devastating everything in its path. Ben Bernanke's super low interest rate policies have systematically pushed investors into stocks and real estate over the past several years because there were few other places where they could get decent returns. As this trade unwinds (and it will likely not be in an orderly fashion), we are going to see unprecedented carnage. Stocks, ETFs, home prices and municipal bonds will all be devastated. And of course that will only be the beginning. What we are ultimately looking at is a sell off very similar to 2008, only this time we will have to deal with rising interest rates at the same time. The conditions for a "perfect storm" are rapidly developing, and if something is not done we could eventually have a credit crunch unlike anything that we have ever seen before in modern times. At the moment, perhaps the most important number in the financial world is the yield on 10 year U.S. Treasuries. A lot of investors are really concerned about how rapidly it has been rising. For example, Patrick Adams, a portfolio manager at PVG Asset Management, was quoted in USA Today as saying the following on Friday... If interest rates keep rising, it is going to have a dramatic effect throughout the economy. In an article that he just posted, Charles Hugh Smith explained some of the things that we might soon see... In addition, rapidly rising interest rates would throw the municipal bond market into absolute chaos. In fact, according to Reuters, nearly 2 billion dollars worth of municipal bond sales were postponed on Thursday because of rising rates... We are rapidly moving into unprecedented territory. Nobody is quite sure what comes next. One financial professional says that municipal bond investors "are in for the shock of their lives"... This is one of the reasons why I write about China so much. China has a tremendous amount of leverage over the global financial system. If China starts selling bonds at about the same time that the Fed stops buying bonds we could see a shift of unprecedented proportions. Sadly, most Americans have absolutely no idea how vulnerable the financial system is. Most Americans have absolutely no idea that our system of finance is a house of cards built on a foundation of risk, debt and leverage. Most Americans have complete and total faith that our leaders know what they are doing and are fully capable of keeping our financial system from collapsing. In the end, most Americans are going to be bitterly, bitterly disappointed.

The Real Cost: Rising Interest Rates and Monthly Mortgage Payments - Wall St. 24/7 - June 21, 2013 - The latest rise in interest rates is already having impact on the on housing affordability. As rates rise, mortgage payments on new and existing home sales go up as well. Even though interest rates are still incredibly low. That being said, we wanted to analyze how the move in the 10-Year Treasury hitting 2.50% for the first time since August of 2011 is going to impact the mortgage costs for borrowers. For starters, many banks are still requiring a 20% down and we are no changing that figure for calculations. The daily mortgage rates advertised at Bankrate.com showed rates ranging from 4.25% up to 4.85%. We decided to use an average home price of $300,000 since the U.S. Census Bureau showed the average home price peaking above $300,000 before the recession and with prices up handily since the last measurement of $272,900 from 2012. We broke this out in a smaller table below. The graph here from Bankrate.com shows that 30-year mortgage rates are getting up to 4.25%, but they were down at 3.50% less than sixty days ago. So on a $300,000 house here is the change in payments after deducting your 20% down and not considering your property tax payments:

20 Signs That The Pharmaceutical Companies Are Running A 280 Billion Dollar Money Making Scam - The End of the American Dream - Michael - June 20th, 2013 - If you could get 70 percent of Americans addicted to your drugs and rake in $280 billion a year in the process, would you do it? If you could come up with a “pill for every problem” and charge Americans twice as much for those pills as people in other countries pay, would you do it? If you could make more money than you ever dreamed possible by turning the American people into the most doped up people in the history of the planet, would you do it? In America today, the number of people hooked on legal drugs absolutely dwarfs the number of people hooked on illegal drugs. And sadly, the number of people killed by legal drugs absolutely dwarfs the number of people killed by illegal drugs. But most Americans assume that if a drug is “legal” that it must be safe. After all, the big pharmaceutical companies and the federal government would never allow us to take anything that would hurt us, right? Sadly, the truth is that they don’t really care about us. They don’t really care that prescription painkillers are some of the most addictive drugs on the entire planet and that they kill more Americans each year than heroin and cocaine combined. They don’t care that antidepressants are turning tens of millions of Americans into zombies and can significantly increase the chance of suicide (just look at the warning label). All the big pharmaceutical companies really care about is making as much money as they possibly can. The following are 20 signs that the pharmaceutical companies are running a $280 billion money making scam…

I will graduate with $100,000 in loans - CNN Money - By Jennifer Liberto - June 19, 2013 - When Kelly Mears graduates from Union College in the summer of 2015, she will have $100,000 in student loans. Armed with a political science degree, Mears will join more than a million Americans who have racked up breathtaking amounts of student debt. Mears is also one of 7 million undergraduates caught in the middle of a debate in Washington over government-subsidized student loans, as interest rates are set to double to 6.8% from 3.4% on July 1. "It just seems to be a part of the growing American experience to go to school, graduate and work off that debt for the rest of your life," Mears said. Super-borrowers with $100,000 of student loan debt aren't the norm. The average student graduates with $27,000 of loan debt. The New York Fed said those who borrow $100,000 or more are about 3.1% of borrowers nationwide. But it's easy to see how students get there, with four years of private college tuition running $116,000 on average, according to the College Board.

Business majors most likely to be underemployed, report finds - CNN Money - Angela Johnson - June 19, 2013 - What you major in can mean the difference between making an annual salary or making Frappucinos post-graduation, according to a recent report. While underemployment is an issue facing many graduates, those who major in business administration and management, criminal justice, drama, English and psychology, are more likely to work in jobs they are overqualified for, according to a report released Tuesday by career web site PayScale.

Based on an analysis of PayScale's 40 million job profiles, the report looked at the top ten majors most affected by underemployment, and the most common jobs graduates with bachelor's degrees in these fields settled for post-graduation. Those who majored in business administration and management are 8.2 times more likely to find work in a job beneath their skill level, the report found. Those with criminal justice and drama degrees are nearly 7 times more likely to be underemployed, and liberal arts, anthropology, psychology and English degree holders aren't doing so well compared to their peers either.

Estimate shows wages would drop under Senate immigration bill, despite economic uptick - Fox News - Published June 19, 2013 - While supporters of the Senate immigration bill tout a new analysis that shows the legislation would boost the economy and trim the deficit, critics are seizing on another, less rosy stat -- the average American wage would drop, and not recover for more than a decade. The analysis from the Congressional Budget Office projected that, if the Senate bill passes, the influx of new immigrants would have the effect of slightly bringing down the average wage. Specifically, the estimate showed average wages for the entire labor force "would be 0.1 percent lower in 2023." It would affect lower- and higher-skilled workers more than those in the middle of the spectrum. The detail, included in a catalog of more positive statistics, was not lost on one of the bill's chief critics, Sen. Jeff Sessions, whose office blasted out the projection as evidence the bill would hurt the workforce. "The wages of U.S. workers -- which should be growing -- will instead decline," Sessions, R-Ala., said. "It would be the biggest setback for poor and middle-class Americans of any legislation Congress has considered in decades." Democrats, and some conservatives, disagree strongly with Sessions on that point. The CBO estimated that the bill would actually boost the economy -- or gross domestic product -- by 3.3 percent over the next decade, and by 5.4 percent the decade after that. Wages would eventually rise, the office said, but not for roughly a dozen years. Effectively, the CBO said it would take time for the economy to catch up with the influx of workers. "As the labor supply initially increased under the legislation, less capital would be available for each worker to produce output, and thus workers' output, on average, would be lower for a time. That decline would reduce average wages relative to those under current law," the report said.

projected that, if the Senate bill passes, the influx of new immigrants would have the effect of slightly bringing down the average wage. Specifically, the estimate showed average wages for the entire labor force "would be 0.1 percent lower in 2023." It would affect lower- and higher-skilled workers more than those in the middle of the spectrum. The detail, included in a catalog of more positive statistics, was not lost on one of the bill's chief critics, Sen. Jeff Sessions, whose office blasted out the projection as evidence the bill would hurt the workforce. "The wages of U.S. workers -- which should be growing -- will instead decline," Sessions, R-Ala., said. "It would be the biggest setback for poor and middle-class Americans of any legislation Congress has considered in decades." Democrats, and some conservatives, disagree strongly with Sessions on that point. The CBO estimated that the bill would actually boost the economy -- or gross domestic product -- by 3.3 percent over the next decade, and by 5.4 percent the decade after that. Wages would eventually rise, the office said, but not for roughly a dozen years. Effectively, the CBO said it would take time for the economy to catch up with the influx of workers. "As the labor supply initially increased under the legislation, less capital would be available for each worker to produce output, and thus workers' output, on average, would be lower for a time. That decline would reduce average wages relative to those under current law," the report said.

DAK Americas closing Navassa plant - (WWAY Wilmington, NC) - Brandon Taylor - June 19, 2013 - Six-hundred people will soon be out of work after a Brunswick County factory closes its doors. Charlotte-based DAK Americas says it will close its plant in Navassa this fall. The company's President and CEO Jorge Young made the announcement earlier this afternoon at a news conference in Wilmington. He says the Cape Fear Manufacturing Site in Navassa will close at the end of September. That means hundreds of full-time and contract workers will be out of work. The plant makes PET resin, polyester staple fiber and raw materials for the other two. Young says today has been a very difficult day, but he says the employees handled the news very professionally. "Closing the Cape Fear Site will strengthen our ability to supply those markets in a more cost competitive way," Young said. Young says the company has put between $100 and $150 million dollars into the plant over the past 12 years. The company says employees will get a severance package.

NC alone in choice to end extended unemployment checks - WRAL (Raleigh) - Bruce Mildwurf - June 20, 2013 - orth Carolina lawmakers had a tough choice this spring: Change how unemployment benefits are calculated, potentially cutting off benefits to tens of thousands of people, or allow the state's debt to the federal government to continue as a drag on the economy. The Tar Heel state was one of many in the same situation, but North Carolina lawmakers were the only ones who chose the quicker fix. Effective July 1, 71,000 people will see their extended benefits end.

During the 1990s, states gradually cut back on the unemployment tax they charged to businesses, explained Duke University economist Aaron Chatterji. When recession hit in 2008, and unemployment claims began to climb, the states lacked the trust fund to pay those benefits. They borrowed from the federal government, and now that bill is coming due. "Most states have these have this deficits with the federal government," Chatterji said. "They are all dealing with it in different ways. North Carolina is unique in terminating the program so abruptly." In order to pay down that debt, lawmakers agreed to a plan that reduces state unemployment compensation, eliminates extended benefits and raises employer contributions into the system. Under the plan, the debt owed will be paid off in 2016, three years early. It takes effect June 30. "We believe it's the right decision," said Sen. Bob Rucho, R-Mecklenburg. "Had we not made these changes to start putting some fiscal sanity back into the system, that fund would not exist for any future people." In a statement issued Friday, Sen. Phil Berger, R-Rockingham pointed the finger of blame on Democratic administrations past.

Senator Rand Paul speaks at Audit IRS Rally

“If The Yield Goes Significantly Higher The Market Is Going To Freak Out” - The Economic Collapse Blog - Michael - June 21st, 2013 - If yields on U.S. Treasury bonds keep rising, things are going to get very messy. As I write this, the yield on 10 year U.S. Treasures has risen to 2.51 percent. If that keeps going up, it is going to be like a mile wide lawnmower blade devastating everything in its path. Ben Bernanke's super low interest rate policies have systematically pushed investors into stocks and real estate over the past several years because there were few other places where they could get decent returns. As this trade unwinds (and it will likely not be in an orderly fashion), we are going to see unprecedented carnage. Stocks, ETFs, home prices and municipal bonds will all be devastated. And of course that will only be the beginning. What we are ultimately looking at is a sell off very similar to 2008, only this time we will have to deal with rising interest rates at the same time. The conditions for a "perfect storm" are rapidly developing, and if something is not done we could eventually have a credit crunch unlike anything that we have ever seen before in modern times. At the moment, perhaps the most important number in the financial world is the yield on 10 year U.S. Treasuries. A lot of investors are really concerned about how rapidly it has been rising. For example, Patrick Adams, a portfolio manager at PVG Asset Management, was quoted in USA Today as saying the following on Friday... If interest rates keep rising, it is going to have a dramatic effect throughout the economy. In an article that he just posted, Charles Hugh Smith explained some of the things that we might soon see... In addition, rapidly rising interest rates would throw the municipal bond market into absolute chaos. In fact, according to Reuters, nearly 2 billion dollars worth of municipal bond sales were postponed on Thursday because of rising rates... We are rapidly moving into unprecedented territory. Nobody is quite sure what comes next. One financial professional says that municipal bond investors "are in for the shock of their lives"... This is one of the reasons why I write about China so much. China has a tremendous amount of leverage over the global financial system. If China starts selling bonds at about the same time that the Fed stops buying bonds we could see a shift of unprecedented proportions. Sadly, most Americans have absolutely no idea how vulnerable the financial system is. Most Americans have absolutely no idea that our system of finance is a house of cards built on a foundation of risk, debt and leverage. Most Americans have complete and total faith that our leaders know what they are doing and are fully capable of keeping our financial system from collapsing. In the end, most Americans are going to be bitterly, bitterly disappointed.

The Real Cost: Rising Interest Rates and Monthly Mortgage Payments - Wall St. 24/7 - June 21, 2013 - The latest rise in interest rates is already having impact on the on housing affordability. As rates rise, mortgage payments on new and existing home sales go up as well. Even though interest rates are still incredibly low. That being said, we wanted to analyze how the move in the 10-Year Treasury hitting 2.50% for the first time since August of 2011 is going to impact the mortgage costs for borrowers. For starters, many banks are still requiring a 20% down and we are no changing that figure for calculations. The daily mortgage rates advertised at Bankrate.com showed rates ranging from 4.25% up to 4.85%. We decided to use an average home price of $300,000 since the U.S. Census Bureau showed the average home price peaking above $300,000 before the recession and with prices up handily since the last measurement of $272,900 from 2012. We broke this out in a smaller table below. The graph here from Bankrate.com shows that 30-year mortgage rates are getting up to 4.25%, but they were down at 3.50% less than sixty days ago. So on a $300,000 house here is the change in payments after deducting your 20% down and not considering your property tax payments:

- $240,000 at 3.50% is $1,077.71 Per Month

- $240,000 at 3.75% is $1,111.48 Per Month

- $240,000 at 4.00% is $1,145.80 Per Month

- $240,000 at 4.25% is $1,180.66 Per Month

- $240,000 at 4.50% is $1,216.04 Per Month

- $240,000 at 5.00% is $1,288.37 Per Month

- $240,000 at 6.00% is $1,438.92 Per Month...

20 Signs That The Pharmaceutical Companies Are Running A 280 Billion Dollar Money Making Scam - The End of the American Dream - Michael - June 20th, 2013 - If you could get 70 percent of Americans addicted to your drugs and rake in $280 billion a year in the process, would you do it? If you could come up with a “pill for every problem” and charge Americans twice as much for those pills as people in other countries pay, would you do it? If you could make more money than you ever dreamed possible by turning the American people into the most doped up people in the history of the planet, would you do it? In America today, the number of people hooked on legal drugs absolutely dwarfs the number of people hooked on illegal drugs. And sadly, the number of people killed by legal drugs absolutely dwarfs the number of people killed by illegal drugs. But most Americans assume that if a drug is “legal” that it must be safe. After all, the big pharmaceutical companies and the federal government would never allow us to take anything that would hurt us, right? Sadly, the truth is that they don’t really care about us. They don’t really care that prescription painkillers are some of the most addictive drugs on the entire planet and that they kill more Americans each year than heroin and cocaine combined. They don’t care that antidepressants are turning tens of millions of Americans into zombies and can significantly increase the chance of suicide (just look at the warning label). All the big pharmaceutical companies really care about is making as much money as they possibly can. The following are 20 signs that the pharmaceutical companies are running a $280 billion money making scam…

Bank of America ordered us to lie, ex-workers say - Commentary: Abused government program to stop foreclosures - Market Watch - Al Lewis - June 19, 2013 - Several former Bank of America employees filed declarations in a federal court last week claiming the mortgage lender told them to lie to customers seeking loan modifications. Bank of America BAC -1.55% fired back, essentially calling them the liars. “Each of the declarations is rife with factual inaccuracies,” the bank responded in a statement emailed to media. Bank of America also attacked the credibility of the lawyers who gathered these declarations as part of a class-action lawsuit filed in 2011 in Boston’s federal district court. “These attorneys are painting a false picture of the bank’s practices,” the bank said in the statement, adding it would respond more thoroughly in court next month. It always makes for engaging courtroom drama when witnesses call the defendant a liar, and then the defendant says the witnesses are liars. But if these witnesses are liars, they’re liars who worked at Bank of America. Read more about the allegations. It’s also worth noting that Bank of America was among five mortgage servicers that reached a $25 billion settlement with state and federal regulators last year to resolve similar allegations of abusive foreclosure practices. And here’s the other thing: Ever since the Obama administration started the Home Affordable Modification Program, or HAMP, in 2009, we’ve been hearing about people who say they applied for a loan modification only to hear that the bank inexplicably lost their paperwork — and then their homes were foreclosed. Former Bank of America employees allege the bank had this paperwork all along. Saying it didn’t was part of a scheme to deny loan modifications and to steer financially troubled customers into more expensive re-financings. Oh, if only Snidely Whiplash, and all the other mustachioed villains from yesteryear’s melodramas, could see the way banks can foreclose on granny’s homestead today. The employees say they got bonuses for denying as many loan modifications as possible. And for putting homes into foreclosure, they say Bank of America rewarded them with gift cards to Target and Bed Bath and Beyond -- where housewares are sold, if you can fathom that irony. The accusations are so outrageous, it’s best to read them in the former employee’s own words — which they have submitted under penalty of perjury.

Staten Island Sandy Victims Charged for Unused Water - The bills have been as high as $500 - WNBC (New York) - Jonathan Vigliotti - June 23, 2013 - Staten Island residents whose homes were devastated by Sandy say the city is charging them hundreds of dollars for water they haven't used since the storm. Some of the bills have been as high as $500, which Rep. Michael Grimm calls ridiculous. "That's $500 these people could use to replace a washer or dryer or refrigerator swept out to sea during Sandy," Grimm said at a press conference Saturday. The Department of Environmental Protection sent a letter to residents saying they were subject to a minimum charge of $1.19 a day even if they weren't using water in their homes. "I couldn't believe what I was seeing, $320 for water," said Stephanie Argento about a bill she got for her South Beach house, which she hasn't been living in. "That's money I could put to my rent."

Grimm said he has contacted the Department of Environmental Protection and asked them to waive the charges but has yet to hear back. Last November DEP suspended billing and interest for more than 9,000 homes that were damaged by Hurricane Sandy and each account has since been carefully reviewed and more than half a million dollars in leak forgiveness has been granted, Ted Timbers, a Department of Environmental Protection spokesman told NBC 4 New York. The Department of Environmental Protection told NBC 4 New York that billing hasn't resumed if a home is uninhabitable.

I will graduate with $100,000 in loans - CNN Money - By Jennifer Liberto - June 19, 2013 - When Kelly Mears graduates from Union College in the summer of 2015, she will have $100,000 in student loans. Armed with a political science degree, Mears will join more than a million Americans who have racked up breathtaking amounts of student debt. Mears is also one of 7 million undergraduates caught in the middle of a debate in Washington over government-subsidized student loans, as interest rates are set to double to 6.8% from 3.4% on July 1. "It just seems to be a part of the growing American experience to go to school, graduate and work off that debt for the rest of your life," Mears said. Super-borrowers with $100,000 of student loan debt aren't the norm. The average student graduates with $27,000 of loan debt. The New York Fed said those who borrow $100,000 or more are about 3.1% of borrowers nationwide. But it's easy to see how students get there, with four years of private college tuition running $116,000 on average, according to the College Board.

Business majors most likely to be underemployed, report finds - CNN Money - Angela Johnson - June 19, 2013 - What you major in can mean the difference between making an annual salary or making Frappucinos post-graduation, according to a recent report. While underemployment is an issue facing many graduates, those who major in business administration and management, criminal justice, drama, English and psychology, are more likely to work in jobs they are overqualified for, according to a report released Tuesday by career web site PayScale.

Based on an analysis of PayScale's 40 million job profiles, the report looked at the top ten majors most affected by underemployment, and the most common jobs graduates with bachelor's degrees in these fields settled for post-graduation. Those who majored in business administration and management are 8.2 times more likely to find work in a job beneath their skill level, the report found. Those with criminal justice and drama degrees are nearly 7 times more likely to be underemployed, and liberal arts, anthropology, psychology and English degree holders aren't doing so well compared to their peers either.

Estimate shows wages would drop under Senate immigration bill, despite economic uptick - Fox News - Published June 19, 2013 - While supporters of the Senate immigration bill tout a new analysis that shows the legislation would boost the economy and trim the deficit, critics are seizing on another, less rosy stat -- the average American wage would drop, and not recover for more than a decade. The analysis from the Congressional Budget Office

projected that, if the Senate bill passes, the influx of new immigrants would have the effect of slightly bringing down the average wage. Specifically, the estimate showed average wages for the entire labor force "would be 0.1 percent lower in 2023." It would affect lower- and higher-skilled workers more than those in the middle of the spectrum. The detail, included in a catalog of more positive statistics, was not lost on one of the bill's chief critics, Sen. Jeff Sessions, whose office blasted out the projection as evidence the bill would hurt the workforce. "The wages of U.S. workers -- which should be growing -- will instead decline," Sessions, R-Ala., said. "It would be the biggest setback for poor and middle-class Americans of any legislation Congress has considered in decades." Democrats, and some conservatives, disagree strongly with Sessions on that point. The CBO estimated that the bill would actually boost the economy -- or gross domestic product -- by 3.3 percent over the next decade, and by 5.4 percent the decade after that. Wages would eventually rise, the office said, but not for roughly a dozen years. Effectively, the CBO said it would take time for the economy to catch up with the influx of workers. "As the labor supply initially increased under the legislation, less capital would be available for each worker to produce output, and thus workers' output, on average, would be lower for a time. That decline would reduce average wages relative to those under current law," the report said.

projected that, if the Senate bill passes, the influx of new immigrants would have the effect of slightly bringing down the average wage. Specifically, the estimate showed average wages for the entire labor force "would be 0.1 percent lower in 2023." It would affect lower- and higher-skilled workers more than those in the middle of the spectrum. The detail, included in a catalog of more positive statistics, was not lost on one of the bill's chief critics, Sen. Jeff Sessions, whose office blasted out the projection as evidence the bill would hurt the workforce. "The wages of U.S. workers -- which should be growing -- will instead decline," Sessions, R-Ala., said. "It would be the biggest setback for poor and middle-class Americans of any legislation Congress has considered in decades." Democrats, and some conservatives, disagree strongly with Sessions on that point. The CBO estimated that the bill would actually boost the economy -- or gross domestic product -- by 3.3 percent over the next decade, and by 5.4 percent the decade after that. Wages would eventually rise, the office said, but not for roughly a dozen years. Effectively, the CBO said it would take time for the economy to catch up with the influx of workers. "As the labor supply initially increased under the legislation, less capital would be available for each worker to produce output, and thus workers' output, on average, would be lower for a time. That decline would reduce average wages relative to those under current law," the report said.DAK Americas closing Navassa plant - (WWAY Wilmington, NC) - Brandon Taylor - June 19, 2013 - Six-hundred people will soon be out of work after a Brunswick County factory closes its doors. Charlotte-based DAK Americas says it will close its plant in Navassa this fall. The company's President and CEO Jorge Young made the announcement earlier this afternoon at a news conference in Wilmington. He says the Cape Fear Manufacturing Site in Navassa will close at the end of September. That means hundreds of full-time and contract workers will be out of work. The plant makes PET resin, polyester staple fiber and raw materials for the other two. Young says today has been a very difficult day, but he says the employees handled the news very professionally. "Closing the Cape Fear Site will strengthen our ability to supply those markets in a more cost competitive way," Young said. Young says the company has put between $100 and $150 million dollars into the plant over the past 12 years. The company says employees will get a severance package.

NC alone in choice to end extended unemployment checks - WRAL (Raleigh) - Bruce Mildwurf - June 20, 2013 - orth Carolina lawmakers had a tough choice this spring: Change how unemployment benefits are calculated, potentially cutting off benefits to tens of thousands of people, or allow the state's debt to the federal government to continue as a drag on the economy. The Tar Heel state was one of many in the same situation, but North Carolina lawmakers were the only ones who chose the quicker fix. Effective July 1, 71,000 people will see their extended benefits end.

During the 1990s, states gradually cut back on the unemployment tax they charged to businesses, explained Duke University economist Aaron Chatterji. When recession hit in 2008, and unemployment claims began to climb, the states lacked the trust fund to pay those benefits. They borrowed from the federal government, and now that bill is coming due. "Most states have these have this deficits with the federal government," Chatterji said. "They are all dealing with it in different ways. North Carolina is unique in terminating the program so abruptly." In order to pay down that debt, lawmakers agreed to a plan that reduces state unemployment compensation, eliminates extended benefits and raises employer contributions into the system. Under the plan, the debt owed will be paid off in 2016, three years early. It takes effect June 30. "We believe it's the right decision," said Sen. Bob Rucho, R-Mecklenburg. "Had we not made these changes to start putting some fiscal sanity back into the system, that fund would not exist for any future people." In a statement issued Friday, Sen. Phil Berger, R-Rockingham pointed the finger of blame on Democratic administrations past.

More U.S. senators concerned by Shuanghui-Smithfield deal - Reuters – June 21, 2013 - More U.S. senators on Friday raised concerns about a Chinese company's plan to buy U.S. pork company Smithfield Foods Inc (SFD.N), particularly in light of restrictions that China continues to place on imports of U.S. meat. "This review must be thorough and take into account the full range of national security interests," the top Democrat and Republican on the Senate Finance Committee said in a letter to U.S. Treasury Secretary Jack Lew and U.S. Trade Representative Michael Froman.

"In particular, we urge that due consideration be given to the impact of the transaction on food safety in the United States," added Senators Max Baucus, a Montana Democrat and the committee's chairman, and Orrin Hatch, a Utah Republican. That echoed a demand made on Thursday by 15 of the 20 members of the Senate Agriculture Committee. Chinese meat company Shuanghui International hopes to buy Smithfield, the world's largest pork producer and processor, for $4.7 billion in what would be the biggest takeover of a U.S. company by a Chinese firm. The companies, out of what lawyers said was "an abundance of caution," filed the proposed deal with the Committee on Foreign Investment in the United States (CFIUS) which reviews foreign investment for any potential threat to national security. Many CFIUS experts believe it is unlikely the Obama administration will decide that Chinese investment in the U.S. food sector is a national security threat. "I think the Chinese will bring home the bacon," said Timothy Keeler, a former U.S. Treasury and trade official who now advises companies with deals that go before CFIUS.

Senator Rand Paul speaks at Audit IRS Rally

Labels:

Economic Relevance

Wednesday, June 19, 2013

City Council Video - June 18, 2013

Preliminarily I am releasing the video of last night's City Council meeting in which a couple items were discussed including an amendment to an Economic Development Agreement with Turbotec Products and a Vacant Building Revitalization and Demolition Grant being awarded to the former Moretz Mill building located near Lenoir-Rhyne Boulevard and Tate Boulevard in SE Hickory.

You will also see Cliff Moone ask Hickory Inc. to broadcast the current video recording they are doing of City Council meetings on the Charter Government channel to make it more accessible to the public.

Labels:

Hickory City Meetings

Monday, June 17, 2013

Economic Stories of Relevance in Today's World -- June 16, 2013

20 Examples Of How America Is Rapidly Going Down The Toilet - End of the American Dream Blog - Michael - on June 13th, 2013 - Toilet - Photo by Tenzinx3Deep corruption is eating away at every level of American society like cancer. We can see this in our families, we can see this in our businesses, and we can especially see this in our government. We have the highest rate of divorce in the world, we have the highest rate of teen pregnancy in the world, we have the highest rate of obesity in world, and nobody has higher rates of cancer, heart disease and diabetes than we do. The suicide rate is soaring and our economy is falling apart. Meanwhile, our politicians seem absolutely clueless and we have piled up the biggest mountain of debt that the world has ever seen. Has America ever been in such bad shape before? The following are 20 examples of how America is rapidly going down the toilet… #1 Why do so many members of the media have family members that work for the White House? Is this one of the reasons why the mainstream media is so soft on Obama? Just check out the following list which was recently compiled by the Washington Post…

Rotting, Decaying And Bankrupt – If You Want To See The Future Of America Just Look At Detroit - The Economic Collapse Blog - Michael - June 16th, 2013 - Eventually the money runs out. Much of America was shocked when the city of Detroit defaulted on a $39.7 million debt payment and announced that it was suspending payments on $2.5 billion of unsecured debt, but those who visit my site on a regular basis were probably not too surprised. Anyone with half a brain and a calculator could see this coming from a mile away. But people kept foolishly lending money to the city of Detroit, and now many of them are going to get hit really hard. Detroit Emergency Manager Kevyn Orr has submitted a proposal that would pay unsecured creditors about 10 cents on the dollar. Similar haircuts would be made to underfunded pension and health benefits for retirees. Orr is hoping that the creditors and the unions that he will be negotiating with will accept this package, but he concedes that there is still a "50-50 chance" that the city of Detroit will be forced to formally file for bankruptcy. But what Detroit is facing is not really that unique. In fact, Detroit is a perfect example of what the future of America is going to look like. We live in a nation that is rotting, decaying, drowning in debt and racing toward insolvency. Already there are dozens of other cities across the nation that are poverty-ridden, crime-infested hellholes just like Detroit is, and hundreds of other communities are rapidly heading in that direction. So don't look down on Detroit. They just got there before the rest of us. The following are some facts about Detroit that are absolutely mind-blowing... (City on the Brink: Detroit Fights to Avoid Bankruptcy - Reuters - June 14, 2013)

Choice of Health Plans to Vary Sharply From State to State - New York Times - REED ABELSON - June 16, 2013 - With only a few months remaining before Americans will start buying coverage through the new state insurance exchanges under President Obama’s health care law, it is becoming clear that the millions of people purchasing policies in the exchanges will find that their choices vary sharply, depending on where they live. States like California, Colorado and Maryland have attracted an array of insurers. But options for people in other states may be limited to an already dominant local Blue Cross plan and a few newcomers with little or no track record in providing individual coverage, including the two dozen new carriers across the country created under the Affordable Care Act... Obama administration officials estimate that most Americans will have a choice of at least five carriers when open enrollment begins in October. There are signs of increased competition, with new insurers and existing providers working harder to design more affordable and innovative plans. In 31 states, officials say there will be insurers that offer plans across state lines. The exchanges will be open to the millions of Americans who are uninsured or already buying individual coverage. Many will be eligible for federal subsidies... People in certain parts of the country may not have the robust choice of insurers that the law sought as a way to keep premiums lower and customer responsiveness high. These people are likely to have few brand-name options to choose from, and they will be gambling on plans offered by insurers new to the individual market as well as brand-new carriers. The choice of providers and costs could also vary as a result... Whether the law ultimately accomplishes its aim of making the insurance markets nationwide more competitive — and plans more affordable — will only become clear over time. Experts expect some insurers to drop out after a year or so, while some other companies may decide to enter, depending on how the markets evolve. Insurers will have to figure out how to offer plans that most people can afford but still provide coverage to those with expensive medical conditions — and, for investor-owned plans, how to make a profit in the meantime... Insurers also say they plan to compete aggressively on price. The new law places strict limits on how much of every dollar of premium can go to anything other than medical expenses, and the insurers say success will depend on enrolling as many customers as possible rather than figuring out how high a premium they can charge to raise profits... The consumer-operated plans, known as co-ops, are also expected to put pressure on other insurers to hold down prices. “We don’t have to return money to stockholders on Wall Street, like for-profit insurers,” said Jerry Burgess, the chief executive of Consumers’ Choice Health Plan, the co-op established in South Carolina. He says the insurer expects to charge little more than the actual costs of its medical care and will lower its premiums if possible. “We would see an opportunity to gain market share by lowering our price,” Mr. Burgess said. “That’s exactly what health reform hopes will happen.”

Bloomberg Plan Aims to Require Food Composting - New York Times - MIREYA NAVARRO - June 16, 2013 - Mayor Michael R. Bloomberg, who has tried to curb soda consumption, ban smoking in parks and encourage bike riding, is taking on a new cause: requiring New Yorkers to separate their food scraps for composting. The building provides food waste containers and bins are kept in the trash rooms on each floor. Dozens of smaller cities, including San Francisco and Seattle, have adopted rules that mandate recycling of food waste from homes, but sanitation officials in New York had long considered the city too dense and vertically structured for such a policy to succeed. Recent pilot programs in the city, though, have shown an unexpectedly high level of participation, officials said. As a result, the Bloomberg administration is rolling out an ambitious plan to begin collecting food scraps across the city, according to Caswell F. Holloway IV, a deputy mayor. The administration plans to announce shortly that it is hiring a composting plant to handle 100,000 tons of food scraps a year. That amount would represent about 10 percent of the city’s residential food waste. Anticipating sharp growth in food recycling, the administration will also seek proposals within the next 12 months for a company to build a plant in the New York region to process residents’ food waste into biogas, which would be used to generate electricity. “This is going to be really transformative,” Mr. Holloway said. “You want to get on a trajectory where you’re not sending anything to landfills.” The residential program will initially work on a voluntary basis, but officials predict that within a few years, it will be mandatory. New Yorkers who do not separate their food scraps could be subject to fines, just as they are currently if they do not recycle plastic, paper or metal.

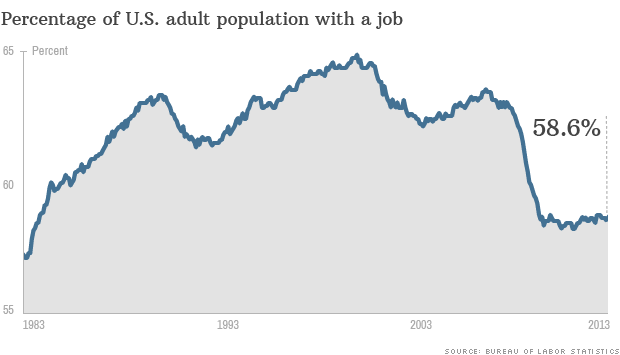

New Math Makes It Easier to Lower Unemployment - CNBC - June 11, 2013 - Conventional wisdom usually dies hard, but one long-held axiom relating to unemployment may be ready for the graveyard. For years, economists have accepted 150,000 as the benchmark number of new jobs needed every month to keep the jobless rate level. Anything above that was supposed to lower the rate, while anything below added to the closely followed headline number.

Obamacare: Is a $2,000 deductible 'affordable?' - CNNMoney - Tami Luhby - June 13, 2013 -

As Prices Rise, Banks Repossess More Homes - CNBC - Diana Olick - June 13, 2013 -

The farm bill, which sailed through the Senate on Monday with $4.1 billion in food stamp cuts, will now be reconciled with the House Agriculture Committee’s bill that took a $20.5 billion bite out of the budget that feeds low income families. A full House vote is expected next week.

But according to The Hill, “Boehner and the GOP leadership are under pressure from fiscal conservatives to make deeper cuts from food stamps and from payments to producers.” How deep might the food stamp cuts go? The idea of implementing at least part of Rep. Paul Ryan [Unlink]’s 2013 budget has surfaced on Capitol Hill, which would virtually gut the program with $135 billion in cuts. That might have anti-government conservatives foaming at the mouth, but the austerity cuts come with a price. As The Nation notes, “Aside from being, well, cruel, the food stamp cuts in the Senate bill are also damaging to the economy. The Center for American Progress, in a study released in March, found that for every $1 billion cut from SNAP, 13,718 jobs are lost.” Regardless of which version of the farm bill emerges, Republicans will likely tout food stamp cuts as an achievement, while failing to admit that it does more to kill jobs than create them – a campaign promise no budget-cutting Republican has yet to fulfill. The concept of smaller government makes for great sound-bites on right wing talk shows, but they are rarely if ever connected to the job losses they cause. As Bill Clinton so astutely stated in September 2012, at the Democratic National Convention, the Republicans have a problem with “arithmetic.” No amount of number-tweaking can change the fact that every dollar taken out of the economy costs jobs, and it doesn’t really matter where the vanishing dollars come from. Author’s note: This report includes opinions and commentary based on independent analysis of official documents and public information.

Rotting, Decaying And Bankrupt – If You Want To See The Future Of America Just Look At Detroit - The Economic Collapse Blog - Michael - June 16th, 2013 - Eventually the money runs out. Much of America was shocked when the city of Detroit defaulted on a $39.7 million debt payment and announced that it was suspending payments on $2.5 billion of unsecured debt, but those who visit my site on a regular basis were probably not too surprised. Anyone with half a brain and a calculator could see this coming from a mile away. But people kept foolishly lending money to the city of Detroit, and now many of them are going to get hit really hard. Detroit Emergency Manager Kevyn Orr has submitted a proposal that would pay unsecured creditors about 10 cents on the dollar. Similar haircuts would be made to underfunded pension and health benefits for retirees. Orr is hoping that the creditors and the unions that he will be negotiating with will accept this package, but he concedes that there is still a "50-50 chance" that the city of Detroit will be forced to formally file for bankruptcy. But what Detroit is facing is not really that unique. In fact, Detroit is a perfect example of what the future of America is going to look like. We live in a nation that is rotting, decaying, drowning in debt and racing toward insolvency. Already there are dozens of other cities across the nation that are poverty-ridden, crime-infested hellholes just like Detroit is, and hundreds of other communities are rapidly heading in that direction. So don't look down on Detroit. They just got there before the rest of us. The following are some facts about Detroit that are absolutely mind-blowing... (City on the Brink: Detroit Fights to Avoid Bankruptcy - Reuters - June 14, 2013)

Choice of Health Plans to Vary Sharply From State to State - New York Times - REED ABELSON - June 16, 2013 - With only a few months remaining before Americans will start buying coverage through the new state insurance exchanges under President Obama’s health care law, it is becoming clear that the millions of people purchasing policies in the exchanges will find that their choices vary sharply, depending on where they live. States like California, Colorado and Maryland have attracted an array of insurers. But options for people in other states may be limited to an already dominant local Blue Cross plan and a few newcomers with little or no track record in providing individual coverage, including the two dozen new carriers across the country created under the Affordable Care Act... Obama administration officials estimate that most Americans will have a choice of at least five carriers when open enrollment begins in October. There are signs of increased competition, with new insurers and existing providers working harder to design more affordable and innovative plans. In 31 states, officials say there will be insurers that offer plans across state lines. The exchanges will be open to the millions of Americans who are uninsured or already buying individual coverage. Many will be eligible for federal subsidies... People in certain parts of the country may not have the robust choice of insurers that the law sought as a way to keep premiums lower and customer responsiveness high. These people are likely to have few brand-name options to choose from, and they will be gambling on plans offered by insurers new to the individual market as well as brand-new carriers. The choice of providers and costs could also vary as a result... Whether the law ultimately accomplishes its aim of making the insurance markets nationwide more competitive — and plans more affordable — will only become clear over time. Experts expect some insurers to drop out after a year or so, while some other companies may decide to enter, depending on how the markets evolve. Insurers will have to figure out how to offer plans that most people can afford but still provide coverage to those with expensive medical conditions — and, for investor-owned plans, how to make a profit in the meantime... Insurers also say they plan to compete aggressively on price. The new law places strict limits on how much of every dollar of premium can go to anything other than medical expenses, and the insurers say success will depend on enrolling as many customers as possible rather than figuring out how high a premium they can charge to raise profits... The consumer-operated plans, known as co-ops, are also expected to put pressure on other insurers to hold down prices. “We don’t have to return money to stockholders on Wall Street, like for-profit insurers,” said Jerry Burgess, the chief executive of Consumers’ Choice Health Plan, the co-op established in South Carolina. He says the insurer expects to charge little more than the actual costs of its medical care and will lower its premiums if possible. “We would see an opportunity to gain market share by lowering our price,” Mr. Burgess said. “That’s exactly what health reform hopes will happen.”

Bloomberg Plan Aims to Require Food Composting - New York Times - MIREYA NAVARRO - June 16, 2013 - Mayor Michael R. Bloomberg, who has tried to curb soda consumption, ban smoking in parks and encourage bike riding, is taking on a new cause: requiring New Yorkers to separate their food scraps for composting. The building provides food waste containers and bins are kept in the trash rooms on each floor. Dozens of smaller cities, including San Francisco and Seattle, have adopted rules that mandate recycling of food waste from homes, but sanitation officials in New York had long considered the city too dense and vertically structured for such a policy to succeed. Recent pilot programs in the city, though, have shown an unexpectedly high level of participation, officials said. As a result, the Bloomberg administration is rolling out an ambitious plan to begin collecting food scraps across the city, according to Caswell F. Holloway IV, a deputy mayor. The administration plans to announce shortly that it is hiring a composting plant to handle 100,000 tons of food scraps a year. That amount would represent about 10 percent of the city’s residential food waste. Anticipating sharp growth in food recycling, the administration will also seek proposals within the next 12 months for a company to build a plant in the New York region to process residents’ food waste into biogas, which would be used to generate electricity. “This is going to be really transformative,” Mr. Holloway said. “You want to get on a trajectory where you’re not sending anything to landfills.” The residential program will initially work on a voluntary basis, but officials predict that within a few years, it will be mandatory. New Yorkers who do not separate their food scraps could be subject to fines, just as they are currently if they do not recycle plastic, paper or metal.

New Math Makes It Easier to Lower Unemployment - CNBC - June 11, 2013 - Conventional wisdom usually dies hard, but one long-held axiom relating to unemployment may be ready for the graveyard. For years, economists have accepted 150,000 as the benchmark number of new jobs needed every month to keep the jobless rate level. Anything above that was supposed to lower the rate, while anything below added to the closely followed headline number.

Not so anymore, according to the Chicago branch of the Federal Reserve . Central bank researchers, in fact, say that because of various factors that number now will be closer to 80,000. Moreover, a paper the Fed recently released on the issue maintains that the number will continue to fall, and at a fairly rapid pace, all the way down to 35,000 by 2016. "The projected slowdown is based on 1) a continuing decline in trend labor force participation attributable to the aging of the baby boomer generation and 2) a lower level of projected population growth going forward," Daniel Aaronson, vice president and director of microeconomic research, and Scott Brave, senior business economist, said in the research paper. "The Census Bureau projects a significant slowdown in population growth from the 1 percent-1.25 percent rate that prevailed for the two decades prior to the most recent recession," they added. If correct, the conclusion has important implications for those trying to gauge the nation's economic health-and in particular the highly influential central bank.

Coverage may be unaffordable for low-wage workers - Associated Press through Yahoo - RICARDO ALONSO-ZALDIVAR - June 13, 2013 - It's called the Affordable Care Act, but President Barack Obama's health care law may turn out to be unaffordable for many low-wage workers, including employees at big chain restaurants, retail stores and hotels. That might seem strange since the law requires medium-sized and large employers to offer "affordable" coverage or face fines. But what's reasonable? Because of a wrinkle in the law, companies can meet their legal obligations by offering policies that would be too expensive for many low-wage workers. For the employee, it's like a mirage — attractive but out of reach. The company can get off the hook, say corporate consultants and policy experts, but the employee could still face a federal requirement to get health insurance. Many are expected to remain uninsured, possibly risking fines. That's due to another provision: the law says workers with an offer of "affordable" workplace coverage aren't entitled to new tax credits for private insurance, which could be a better deal for those on the lower rungs of the middle class. Some supporters of the law are disappointed. It smacks of today's Catch-22 insurance rules. "Some people may not gain the benefit of affordable employer coverage," acknowledged Ron Pollack, president of Families USA, a liberal advocacy group leading efforts to get uninsured people signed up for coverage next year.

Obamacare: Is a $2,000 deductible 'affordable?' - CNNMoney - Tami Luhby - June 13, 2013 -

Until now, much of the debate swirling around Obamacare has focused on the cost of premiums in the state-based health insurance exchanges. But what will enrollees actually get for that monthly charge? States are starting to roll out details about the exchanges, providing a look at just how affordable coverage under the Affordable Care Act will be. Some potential participants may be surprised at the figures: $2,000 deductibles, $45 primary care visit co-pays, and $250 emergency room tabs. Those are just some of the charges enrollees will incur in a silver-level plan in California, which recently unveiled an overview of the benefits and charges associated with its exchange. That's on top of the $321 average monthly premium. For some, this will be great news since it will allow them to see the doctor without breaking the bank. But others may not want to shell out a few thousand bucks in addition to a monthly premium. "The hardest question is will it be a good deal and will consumers be able to afford it," said Marian Mulkey, director of the health reform initiative at the California Healthcare Foundation. "The jury is still out. It depends on their circumstances." A quick refresher on Obamacare: People who don't have affordable health insurance through their employers will be able to sign up for coverage through state-based exchanges. Enrollment is set to begin in October, with coverage taking effect in January. You must have some form of coverage next year, or you will face annual penalties of $95 or 1% of family income (whichever is greater) initially and more in subsequent years. Each state will offer four levels of coverage: platinum, gold, silver and bronze. Platinum plans come with the highest premiums, but lowest out-of-pocket expenses, while bronze plans carry lower monthly charges but require more cost-sharing. Gold and silver fall in the middle. The federal government will offer premium subsidies to those with incomes of up to four times the federal poverty level. This year, that's $45,960 for an individual or $94,200 for a family of four. There will be additional help to cover out-of-pocket expenses for those earning less than 250% of the poverty line: $28,725 for a single person and $58,875 for a family of four. The subsidies are tied to the cost of the state's silver level plans.

As Prices Rise, Banks Repossess More Homes - CNBC - Diana Olick - June 13, 2013 -

As real estate gains value nationwide, banks are acting more quickly on delinquent loans and repossessing more homes. For years the process has been slow and arduous, with hundreds of thousands of borrowers living in homes for months, even years after they had stopped paying the mortgage. That is now changing. So-called REO (real estate owned) activity by banks, when the bank takes ownership of the property, increased 11 percent in May from the previous month, according to RealtyTrac. "You have an environment now with rising home prices in most markets," said Daren Blomquist of RealtyTrac. "That gives the banks more incentive to go ahead and foreclose on these homes because they know they can turn around and sell them quickly for a price that is higher than what they would have been able to sell them a year ago."

House farm bill cuts food stamps, kills jobs - All Voices - June 14, 2013 - Despite significant progress toward shrinking the federal deficit, House Republicans are pushing ahead with deep spending cuts that specifically target the poor and would kill more than 170,000 jobs. The farm bill, which sailed through the Senate on Monday with $4.1 billion in food stamp cuts, will now be reconciled with the House Agriculture Committee’s bill that took a $20.5 billion bite out of the budget that feeds low income families. A full House vote is expected next week.

But according to The Hill, “Boehner and the GOP leadership are under pressure from fiscal conservatives to make deeper cuts from food stamps and from payments to producers.” How deep might the food stamp cuts go? The idea of implementing at least part of Rep. Paul Ryan [Unlink]’s 2013 budget has surfaced on Capitol Hill, which would virtually gut the program with $135 billion in cuts. That might have anti-government conservatives foaming at the mouth, but the austerity cuts come with a price. As The Nation notes, “Aside from being, well, cruel, the food stamp cuts in the Senate bill are also damaging to the economy. The Center for American Progress, in a study released in March, found that for every $1 billion cut from SNAP, 13,718 jobs are lost.” Regardless of which version of the farm bill emerges, Republicans will likely tout food stamp cuts as an achievement, while failing to admit that it does more to kill jobs than create them – a campaign promise no budget-cutting Republican has yet to fulfill. The concept of smaller government makes for great sound-bites on right wing talk shows, but they are rarely if ever connected to the job losses they cause. As Bill Clinton so astutely stated in September 2012, at the Democratic National Convention, the Republicans have a problem with “arithmetic.” No amount of number-tweaking can change the fact that every dollar taken out of the economy costs jobs, and it doesn’t really matter where the vanishing dollars come from. Author’s note: This report includes opinions and commentary based on independent analysis of official documents and public information.

Labels:

Economic Relevance

Thursday, June 13, 2013

Newsletter about the City Council meeting of June 4, 2013

This newsletter is about the Hickory City Council meeting that I attended this past week. City council meetings are held on the first and third Tuesdays of each Month in the Council Chambers of the Julian Whitener building.

At right of this page under Main Information links is an Hickory's City Website link. If you click on that link, it takes you to our city’s website, at the left of the page you will see the Agenda's and Minutes link you need to click. This will give you a choice of PDF files to upcoming and previous meetings.

You will find historic Agenda and Minutes links. Agendas show what is on the docket for the meeting of that date. The Minutes is an actual summary of the proceedings of the meeting of that date.

Here is a summary of the agenda of the meeting. There were a couple of important items that were discussed at this meeting and the details are listed further below:

Please remember that pressing Ctrl and + will magnify the text and page and pressing Ctrl and - will make the text and page smaller. This will help the readability for those with smaller screens and/or eye difficulties.

City Website has changed - Here is a link to the City of Hickory Document Center

All materials and maps for this meeting are provide at this link:

City Council Meeting Agenda June 4, 2013 (11MB)

(:25) Invocation by Rev. Jay Robison, Viewmont Baptist Church

Special Presentations

A. (2:10) Presentation by Michael Willis of Marlowe and Company

B. (6:20) Presentation by Carolina Moonlighters and Proclamation for Barbershop Harmony Week.

Citizens Requesting to Be Heard (15:55)

Dr. Glenn Pinckney addresses Council representing "Christians aligned for Actions and Principles." This is a non-political, non-religious organization created for the purpose of disseminating information. They are looking to have an event with Dr. Ben Carson, Mark Harris, and Barry Black to speak to the Values of Education on August 22, 2013 at the Hickory Metro Convention Center.

Larry Pope addressed the Council about the City Council forms relating to conflicts of interest that he has requested. The City officials only provided the information up to the year 2008 and Mr. Pope wants the most recent information provided up until 2012.

Consent Agenda (24:10)

A. Nomination of Former Whisnant Hosiery Mills (Moretz Mills) to the National Register of Historic Places. - The oldest section of the Whisnant Hosiery Mill was built in 1929 with additional sections constructed in 1937, the 1940s, the 1950s, and 1966. The majority of the building is one level, but the 1937 section, which faces E Avenue is two stories. The building is located at 74 8th Street SE near the intersection of E Avenue SE and Lenoir Rhyne Blvd SE. The owner’s plan is to renovate the structure for office, retail, and personal service uses. The building’s historical significance stems from its association with events that have made a significant contribution to the broad patterns of our history, namely its association with the development of the hosiery industry in Hickory.

The Hickory Historic Preservation Commission held a public hearing on May 14, 2013. A representative of the property owner spoke in favor of the nomination. The Historic Preservation Commission voted unanimously to recommend approval of the nomination. Staff recommends that City Council recommend that the Whisnant Hosiery Mills be placed on the National Register of Historic Places.

B. Approval of a Proclamation for North Carolina Domestic Violence Proclamation 100 Day.

C. Approval of a Proclamation for Pulmonary Hypertension Awareness Month.

D. Resolution – Cancellation of July 2, 2013 City Council Meeting. - Be it resolved by the City Council of the City of Hickory that the regularly scheduled City Council Meeting for July 2, 2013 be cancelled. (This meeting in July has traditionally been cancelled by the City Council.)

E. Change Order to Contract with Davis & Floyd, Inc. for Hickory-Catawba Wastewater Treatment Plant (HCWWTP) Upgrade Project in the Amount of $9,000. - This construction administration services task order number one change order consist of three items related to additional services required by the Public Utilities Department. All three items are related to requirements to alter the plans in order for Catawba County Building Inspections to approve the plans and issue a permit for construction.

● Appendix A and B completion $5,000

● Supplemental Dwg’s ASD-01, CSD-01, 02, and 03 $2,000

● Supplemental Dwg’s SSD-01 $2,000

This change order will result in a total change order amount of $9,000 which represents approximately 1.73% of the original contract amount, and .75% of the projects $1.2 million contingency. The project is a 50/50 partnership with Catawba County and the County will pay half of the change order. No budget amendment is required.

F. Change Order to Contract with Jimmy R. Lynch & Sons for the Hickory-Catawba Wastewater Treatment Plant (HCWWTP) Upgrade Project in the Amount of $61,047.43. - Change order one consists of five items related to unanticipated conditions that have arisen during construction and one item that is recommended for inclusion with the project that was eliminated during the plan modifications. The single largest item that is included in this change order is $34,830.40 for extension of a new 6-inch waterline along 6th Avenue to the facility replacing the existing 2-inch galvanized waterline. This upgrade is necessary due to fire protection requirements and flow demands of equipment to be used in the treatment process. All other items are related to unanticipated conditions and have arisen through construction activities. The largest of the remaining items is for

$15,755.53 for removal of unsuitable soil, undercutting of areas and installation of surge stone and fabric to restore structural value. Contract change order total to date is $61,047.43 or .59% of the original project contract, and 5% of the projects $1.2 million contingency fund. The project is a 50/50 partnership with Catawba County and the County will pay half of the change order. No budget

amendment is required.

G. Request to Join The Interlocal Purchasing System (TIPS/TAPS). - The Interlocal Purchasing System (TIPS/TAPS) is available for use by all government entities and is located in Pittsburg, Texas. They provide a purchasing co-op which is beneficial to both vendors and members by meeting all competitive bidding process requirements. The City of Hickory is currently not a member of this purchasing system. Membership does not obligate the City to purchase through the system, but provides an additional opportunity for the City to find the best prices for applicable purchases.

H. Call for Public Hearing - For the Consideration of Rezoning Petition 13-09 for the Property Located at 3254 NC Hwy 127 South, Hickory. (Authorize Public Hearing for June 18, 2013)

I. Write Offs for Fiscal Year 2012-2013 in the Amount of $204,927.71. - North Carolina General Statutes establish all Street Assessments and Property Taxes that are over ten (10) years old are no longer collectable and should be written off in conjunction with the annual audit. For the current fiscal year (FY 12-13), there are no Street Assessments to be written off, but there is $85,441.92 in Property Taxes. The City of Hickory’s Accounting Division requires all other accounts that are over eighteen (18) months in arrears be written off to comply with Generally Accepted Accounting Principles in order to more fairly represent financial assets of the City on the balance sheet. For the

current fiscal year, this amounts to $119,485.79. Current fiscal year write-offs total $204,927.71, compared to $233,294.97 that was written off in FY 11-12. Even though these accounts will be written off, the Finance Division will continue to pursue collection of the debts. All accounts over $50.00 that are eligible are submitted to the North Carolina Debt Setoff Program for collection. Staff recommends approval to write-off uncollectable accounts for Fiscal Year 2012-2013.

J. Approval of a Parking Lot Lease Agreement between the City of Hickory and the Western Piedmont Regional Transit Authority - WPRTA fully operates the bus transit station and therefore needs dedicated parking spaces for its employees. WPRTA employees have been using spaces in lot number three. Lot number three consists of .07 acres as shown in Plat Book 66, at Page 26, and contains five (5) parking spaces, including one handicapped space. WPRTA needs all

five spaces. The lease is for a term of ten (10) years for the sum of one ($1.00) dollar per year. The City retains full ownership of lot number three.

K. Approval of a Quitclaim Deed to Convey the Piedmont Bus Transit Station Property from the City of Hickory to the Western Piedmont Regional Transit Authority (WPRTA) - The City of Hickory built the bus transit station located at 285 2nd Avenue SW in 2010 using local funds and federal grant funds. Through discussions with the WPRTA it was determined that the City of Hickory would build the bus transit station and be the lead entity in applying for and receiving the federal funds. It was further determined by the City and WPRTA that the City of Hickory would convey the bus transit station property to WPRTA upon completing the project. WPRTA fully operates the bus transit station and therefore needs full access to and control of the property where the building and canopy are situated. This conveyance will give WPRTA full ownership of the building and property upon which it is located.

L. Budget Ordinance Amendment Number 19.

1. To budget a $50 Library donation in the Library Books Supplies line item.

2. To transfer $2,290 of International Council donations to the Boards and Commissions-International Council expenditure line item.

3. To budget a $90 Parks and Recreation-Westmont Senior Center donation in the Parks and Recreation Department Supplies line item.

4. To budget $1,350 of Parks and Recreation-Miscellaneous Donations in the Recreation Supplies line item. Donations are for the Parks and Recreation Tennis Program.

5. To budget a $1,000 Parks and Recreation-Senior Games donation in the Parks and Recreation Department Supplies line item. This donation is for Senior Games meals.

6. To budget $7,439 of Parks and Recreation Senior Games Registration Fees in the Parks and Recreation Department Supplies line item. Senior Games is an annual event organized by the Parks and Recreation department.

7. To transfer $240,000 of Compensation Adjustments to the Public Safety and Economic and Community Development operational budgets to cover the impact of merit pay increases granted in FY12-13. Merit increases granted in other departments during FY12-13 were cover by lapsed salaries.

8. To appropriate $2,522 of General Fund Balance (Funds reserved from the State of North Carolina Un-Authorized Substance Tax revenue) and budget in the Police Department's C/O Vehicles ($726) and Departmental Supplies ($1,796) line items. This amendment is necessary to cover overages in the line items and maintain a balanced budget. Funds are made available to the Police Department from the State and remain in General Fund Balance until appropriated.

9. To transfer $111,000 from the Police Department operational budget to the radio upgrade and re-banding project. In addition this budget amendment will transfer $60,506 of Capital Reserve Fund investment earnings to the Capital Project. Funds are to pay Sprint Nextel for the Pro Voice Software as part of re-banding the radio system, and to close out this capital project.

10. To transfer $66,825 of designated fuel reserve funds to several departments fuel and motor oil operational line items. This transfer is necessary to cover the projected overages in fuel costs in the current fiscal year. These funds are a portion of the $1 million previously set aside by City Council to meet the rising cost of fuel. Any remaining funds at year end will be transferred back to the Fuel Reserve for future needs.

11. To budget a $95,086 transfer of unused revenue from the Clement Boulevard Extension project to the General Fund-Appropriated Fund Balance. This amendment is necessary to make the final transfer back to the General Fund, and to close out this capital project.