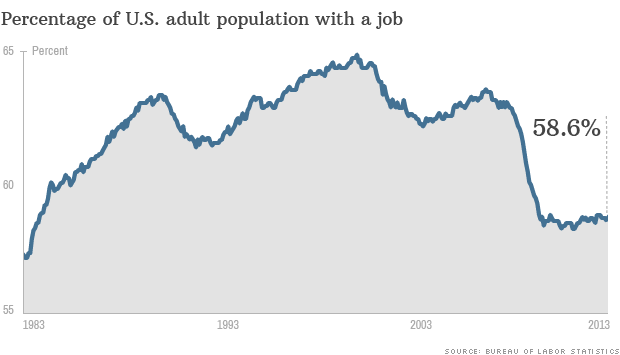

Forget the unemployment rate. The employment rate -- the percentage of adult Americans who hold a job -- has barely budged in the past three years. It's hovering near its lowest level in three decades, and it's unlikely to improve when the Labor Department releases its May jobs report on Friday. About 58.6% of the civilian population over age 16 had a job as of April, according to the U.S. Bureau of Labor Statistics. This rate -- officially called the "employment-population ratio" -- has been stuck in that range for several years. The last time it was this low was in 1983. Looking at the job market using that measure paints a stark picture. Sure, companies have been hiring, but they've been creating jobs at a pace that merely keeps up with recent population growth. It's not enough to also make up for the jobs lost in the crisis.

U.S. Small Businesses Cut Jobs In May: NFIB - Reuters through Huffington Post - June 5, 2013 - U.S. small businesses cut back on staff slightly in May, the first decline in six months and a sign of weakness in the job market recovery. The National Federation of Independent Business said on Wednesday employment shrank by 0.04 workers per firm last month. It was the second report of the day to augur poorly for the government's national employment report due on Friday, which is expected to show a modest 170,000 jobs were created last month. Earlier on Wednesday, payroll processing firm ADP said U.S. companies added 135,000 workers in May, well below the 165,000 forecast by analysts polled by Reuters.

Companies Spending Cash on Investors, Not Workers - CNBC - Jeff Cox - June 5, 2013 - Companies flush with cash remain reluctant to hire or make capital purchases, choosing to reward investors rather than expand their businesses. Recent economic data exemplify the trend: Private payrolls grew by just 135,000 during May, according to ADP, while employment components both for the Institute of Supply Management's manufacturing and nonmanufacturing indexes show a flat jobs outlook. The grim hiring prospects come as nonfinancial firms hold nearly $1.8 trillion in cash on their balance sheets. Rather than look to expand, though, they've chosen to participate in aggressive share buybacks and dividend increases to reward investors. According to TrimTabs, companies have spent $290.7 billion this year on buybacks, which are aimed at decreasing the amount of available shares—or float—thus driving up stock prices. That effort, at least, has been a success. The Standard & Poor's 500 has gained more than 13 percent in 2013, led by big gains in financials and health care stocks. Worried about growth prospects, S&P 500 companies have been passing out dividend payments with a free hand as well, rewarding shareholders with a record $37.5 billion thus far, rather than hiring.

Meet Your New Boss: Buying Large Employers Will Enable China To Dominate 1000s Of U.S. Communities - The Economic Collapse Blog - June 6, 2013 - Are you ready for a future where China will employ millions of American workers and dominate thousands of small communities all over the United States? Such a future would be unimaginable to many Americans, but the truth is that it is already starting to happen. Chinese acquisition of U.S. businesses set a new all-time record last year, and it is on pace to absolutely shatter that record this year. Meanwhile, China is voraciously gobbling up real estate and is establishing economic beachheads all over America. If China continues to build economic power inside the United States, it will eventually become the dominant economic force in thousands of small communities all over the nation. Just think about what the Smithfield Foods acquisition alone will mean. Smithfield Foods is the largest pork producer and processor in the world. It has facilities in 26 U.S. states and it employs tens of thousands of Americans. It directly owns 460 farms and has contracts with approximately 2,100 others. But now a Chinese company has bought it for $4.7 billion, and that means that the Chinese will now be the most important employer in dozens of rural communities all over America. If you don't think that this is important, you haven't been paying much attention to what has been going on in the world. Thanks in part to our massively bloated trade deficit with China, the Chinese have trillions of dollars to spend. They are only just starting to exercise their economic muscles. And it is important to keep in mind that there is often not much of a difference between "the Chinese government" and "Chinese corporations". In 2011, 43 percent of all profits in China were produced by companies that the Chinese government had a controlling interest in. Americans are accustomed to thinking of "government" and "business" as being separate things, but in China they are often one and the same. Even when there is a separation in ownership, the reality is that no major Chinese corporation is going to go against the authority and guidance of the Chinese government. The relationship between government and business in China is much different than it is in the United States. Over the past several years, Chinese companies have become increasingly aggressive. Last year a Chinese company spent $2.6 billion to purchase AMC entertainment - one of the largest movie theater chains in the United States. Now that Chinese company controls more movie ticket sales than anyone else in the world. At the time, that was the largest acquisition of a U.S. firm by a Chinese company, but now the Smithfield Foods deal has greatly surpassed that.

But China is not just relying on acquisitions to expand its economic power. The truth is that "economic beachheads" are being established all over America. For example, Golden Dragon Precise Copper Tube Group, Inc. recently broke ground on a $100 million plant in Thomasville, Alabama. I am sure that many of the residents of Thomasville, Alabama will be glad to have jobs, but it will also become yet another community that will now be heavily dependent on communist China.

And guess where else Chinese companies are putting down roots? Detroit. Yes, the poster child for the deindustrialization of America is being invaded by the Chinese. The following comes from a recent CNBC article...

Fast Food Workers In Another City Strike: 'We've Been Pushed To The Edge' - AOL - AOL Jobs Contributor - May 30th, 2013 - Fast food workers in Seattle walked off their jobs late Wednesday and Thursday. That made Seattle the seventh city where fast food workers have gone on strike in recent months. A Taco Bell server in Seattle explains here why she (along with her co-workers) walked off the job Wednesday night -- shutting down a Taco Bell restaurant. Taco Bell declined to comment, referring inquiries to the National Restaurant Association, which stressed the industry provides "13 million job opportunities" and remains "one of the best paths to achieving the American dream." The full statement is below.

Another Phony Jobs Report From A Government That Lies About Everything – Paul Craig Roberts - June 7, 2013 - ...For a decade this has been the jobs profile of “the world’s most powerful economy.” It is the profile of third world India 40 years ago. The jobs that made the US the dominant economy have been moved off shore by corporations threatened by Wall Street with takeovers if they did not increase their profits. The easiest way for corporations to increase profits is to take advantage of cheap labor in countries with massive quantities of unemployed labor. So, if we believe the BLS report, and the reported new jobs are not simply a product of faulty season adjustments and a faulty birth-death model, why is the financial press happy that the US economy can only create third world jobs? Why was the stock market up on the news that the US economy has created 179,000 third world jobs? Would rational markets be up on such discouraging news? But are the jobs really there? With retail sales going nowhere, why 35,600 new jobs in wholesale and retail trade? With real median incomes declining, why 38,100 more waitresses and bartenders? For every month as long as I can remember the BLS reports numerous new jobs in waitresses and bartenders, despite the long-term decline in real median income. In the May jobs report, where are the jobs for the vast number of new college graduates? The US now has more hotel maids, bartenders, and waitresses than it has manufacturing workers. The US has twice as many people employed in government than in manufacturing. The services of maids, bartenders, waitresses, and government cannot be exported. Therefore, the US trade deficit remains large and without exports to reduce it, a crisis in itself. What the BLS jobs reports have been telling us for many years is that the US economy is in crisis, in a death-spiral. Yet, not a handful of economists’ voices have been raised.

Today president obama’s economist said that the notch upward in the unemployment rate was because the economic outlook was so good that more people were encouraged to enter the labor market than there were new jobs available. The conclusion is inescapable: The same government that lies about weapons of mass destruction, Saddam Hussein’s al-Qaeda connections, Iranian nukes, and so on, also lies about jobs, the unemployment rate, the inflation rate, rigs every financial and commodity market, pretends that terrorism is such a threat that the US Constitution must be set aside and that Americans are safer without the protection of habeas corpus and due process.

Real Unemployment Rate: 11.3% - Zero Hedge - Tyler Durden - June 7, 2013 - ... What is laughable is that for all talk of demographic issues, the big drop started with the Great Financial Crisis, and has barely bottomed. This is even more laughable when one considers that it is the older workers, or those who supposedly should be retiring if one buys the propaganda narrative, who have seen the bulk of job gains in the past 5 years. In short: this is merely a favorite BLS gimmick to push the unemployment rate lower for purely political reasons (to the benefit of the administration that makes the content of your emails the most transparent to NSA workers, ever).

The problem is that this transitory fudging gimmick would be sustainable if the US population was no longer rising, however since there is no indication of any taper on the horizon, sooner or later, the historical labor force participation rate will have to be regained. Logically, when that happens, the unemployment rate will have no choice but to soar as the Labor Force soars month after month because sadly even the great welfare state of America has only so much funds it can allocate to an inert population that does no work and merely sits around all day long. So how does the narrow unemployment rate (U-3, not to be confused with the wider, Underemployment U-6 rate) look if one applies a longer-term average Labor Force Participation rate of 65.8%? In a word: not pretty. As of May, assuming realistic LFP assumptions, the real U-3 unemployment rate should have been not 7.6% but 11.3%.

Number Of Older Workers (55 And Over) Rises To New Record High - Zero Hedge - Tyler Durden - June 7, 2013 - In the latest installment of another long-running series, we look at the age bracket distribution of those who are lucky enough to get new jobs each month, versus those who aren't. It should come as no surprise that once more the majority of new jobs created in the month of May went to the oldest age-group cohort, those 55 and older, which saw an increase of 203,000 jobs in May, more than every other age group bracket. The result: with an all time high 31,488,000 workers aged 55-69, Americans are far more busy working in their older years than retiring (or gambling in the rigger stock market casino).

Where The (Low-Paying) Jobs Were Are - Zero Hedge - Tyler Durden - June 7, 2013 -

The time has come to look at the quality component of the 175K jobs added in May, so without further ado, let's drill down at where the growth was. Without much surprise, we find that as in months past, the bulk of the job growth continues to be concentrated in the lowest wage jobs:

- Leisure and Hospitality added the most jobs in May, 43K

- Retail Trade jobs rose by 28K

- Education and health added another 26K

- Temp jobs: the lowest of all paying jobs added another 26K

Pimco's Gross Skewers Bernanke: You're Part of the Problem - CNBC - June 4, 2013 - Jeff Cox - Bond guru Bill Gross has taken straight aim at the Federal Reserve and its Chairman Ben Bernanke, charging that ultra-loose monetary policies are holding back the economic recovery. In his monthly letter to investors, Gross, who heads fixed-income giant Pimco and its $2 trillion in assets under management, uses unusually blunt language to convey his feelings about historically aggressive central bank easing measures. While he concedes that the Fed isn't getting help from Washington and its fiscal mess, he said the central bank's easing programs are only complicating matters. Gross compares the economy to a heart that uses the ability to earn return appreciably over the cost of investment—"carry," in market terms—as its lifeblood. Carry has been increasingly difficult to achieve in the current quantitative easing environment, he said. "Perhaps, in addition to a fiscally confused Washington, it's your policies that may be now part of the problem rather than the solution," Gross said in comments directed at Bernanke.

No comments:

Post a Comment