Fed Says Growth Lifts the Affluent, Leaving Behind Everyone Else - News York Times - BINYAMIN APPELBAUM - September 4, 2014 - Economic growth since the Great Recession has improved the fortunes of the most affluent Americans even as the incomes and wealth of most American families continue to decline, the Federal Reserve said Thursday. For the most affluent 10 percent of American families, average incomes rose by 10 percent from 2010 to 2013. For the rest of the population, average incomes were flat or falling. The least affluent families had the largest declines. Average incomes dropped by 8 percent for the bottom 20 percent of families, the Fed reported in its triennial Survey of Consumer Finances, one of the most comprehensive sources of data on the financial health of American families. The new report, broadly consistent with other data on the aftermath of the Great Recession, underscores why so many Americans think the economy remains in poor health. While the pie has grown, most people are getting smaller slices. The result is that wealth also is increasingly concentrated. While overall wealth barely changed during the survey period, the money sloshed from the bottom toward the top. For the top 10 percent of families, ranked by income, estimated average wealth increased by 2 percent to $3.3 million. For the bottom 20 percent of families, average wealth sharply declined by 21 percent to $65,000. There is growing evidence that inequality may be weighing on economic growth by keeping money disproportionately in the hands of those who already have so much they are less inclined to spend it...

If The Economy Is Recovering, Why Is The Labor Force Participation Rate At A 36 Year Low? - The Economic Collapse Blog - Michael Snyder - September 7th, 2014- Should we be concerned that the percentage of Americans that are either working or looking for work is the lowest that it has been in 36 years? In August, an all-time record high 92,269,000 Americans 16 years of age and older did not "participate in the labor force". And when you throw in the people that are considered to be "in the labor force" but are not currently employed, that pushes the total of working age Americans that do not have jobs to well over 100 million. Yes, it may be hard to believe, but there are more than 100 million working age Americans that are not employed right now. Needless to say, this is not a sign of a healthy economy, and it is a huge reason why dependence on the government has soared to absolutely unprecedented levels. When people can't take care of themselves, they need someone else to take care of them. If the percentage of people in the labor force continues to decline like it has been, what is that going to mean for the future of our society? The chart below shows the changes in the civilian labor force participation rate since 1980. As you can see, the rate steadily rose between 1980 and 2000, but since then it has generally been declining. In particular, this decline has greatly accelerated since the beginning of the last recession...

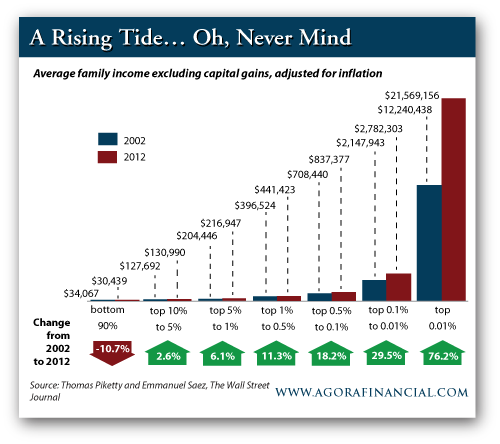

How to Protect Your Wealth from Fed Monetary Policy - The Daily Reckoning - Dave Gonigam - September 5, 2014 - "This is the biggest redistribution of wealth from the middle class and the poor to the rich ever,” said Stanley Druckenmiller a year ago. Mr. Druckenmiller is a hedge fund legend. He was George Soros’ right-hand man for 12 years. The “this” he referred to was the Federal Reserve’s perpetual easy-money policy since the Panic of 2008. Druckenmiller offered up one of the most candid admissions you’ll ever hear from the power elite...

A Lie That Serves The Rich - the truth about the American economy - Paul Craig Roberts, John Titus, and Dave Kranzler - September 4, 2014 - The labor force participation rate has declined from 66.5% in 2007 prior to the last downturn to 62.7% today. This decline in the participation rate is difficult to reconcile with the alleged economic recovery that began in June 2009 and supposedly continues today. Normally a recovery from recession results in a rise in the labor force participation rate. The Obama regime, economists, and the financial presstitutes have explained this decline in the participation rate as the result of retirements by the baby boomers, those 55 and older. In this five to six minute video, John Titus shows that in actual fact the government’s own employment data show that baby boomers have been entering the work force at record rates and are responsible for raising the labor force participation rate above where it would otherwise be. http://www.tubechop.com/watch/3544087 It is not retirees who are pushing down the participation rate, but those in the 16-19 age group whose participation rate has fallen by 10.4%, those in the 22-14 age group whose participation rate has fallen by 5.4%, and those in the 24-54 age group whose participation rate is down 2.5%. The offshoring of US manufacturing and tradable professional service jobs has resulted in an economy that can only create new jobs in lowly paid, increasingly part-time nontradable domestic service jobs, such as waitresses, bartenders, retail clerks, and ambulatory health care workers. These are not jobs that can support an independent existence. However, these jobs can supplement retirement incomes that have been hurt by many years of the Federal Reserve’s policy of zero or negative interest rates. Those who were counting on interest earnings on their savings to supplement their retirement and Social Security incomes have reentered the labor force in order to fill the gaps in their budgets created by the Fed’s policy. Unlike the young who lack savings and retirement incomes, the baby boomers’ economic lives are not totally dependent on the lowly-paid, part-time, no-benefits domestic service jobs. Lies are told in order to make the system look acceptable so that the status quo can be continued. Offshoring America’s jobs benefits the wealthy. The lower labor costs raise corporate profits, and shareholders’ capital gains and performance bonuses of corporate executives rise with the profits. The wealthy are benefitting from the fact that the US economy no longer can create enough livable jobs to keep up with the growth in the working age population. The clear hard fact is that the US economy is being run for the sole benefit of a few rich people.

Economy in Severe Trouble-John Williams - USA Watchdog - By Greg Hunter - September 1, 2014 - John Williams of Shadowstats.com is forecasting a possible dollar sell-off by the end of 2014. Williams predicts this will trigger the beginning of hyperinflation. Are we on track for this prediction? Williams contends, “Everything the Fed has been doing to pump this extraordinary amount of liquidity into the system, since the panic of 2008, has been aimed at propping up the banks. . . . The banks are still in trouble. From here on in, it’s going to get worse, and as it does, the Fed is going to have to pump more liquidity into the system. . . . They will use the poor economy as a political shield. As the economy turns down . . . the Fed has to do more, and all these factors will come together in a great confluence, and that will give us selling pressure in the U.S. dollar. With this selling pressure, there will be upside pressure on commodity prices, and that will be the early trigger for hyperinflation.” On the issue of bank bail-ins, will they happen? Williams says, “Nope, the Fed’s basic mandate is to keep the banking system afloat. I can’t envision a Fed that would want to see people losing their money because of what it does to the banking system. The problem with depositors bailing out the banks is that it encourages bank runs. It’s the run on the banks that the central banks have to avoid. . . . I doubt they would take actions that would trigger a big run on the banks.” So, instead, Williams says the Fed will just keep printing money to keep the banks afloat. Join Greg Hunter of USAWatchdog.com as he goes One-on-One with economist John Williams.

Chiquita's Tax Inversion Deal Could Be In Trouble - The Huffington Post - Alexander C. Kaufman - September 7, 2014 - Banana giant Chiquita Brands International’s plan to move to Ireland to dodge U.S. taxes may be in trouble. Institutional Shareholder Services, an influential firm that advises investors, urged shareholders to vote against Chiquita’s plan to merge with Irish rival Fyffes. Instead, the company should accept a joint takeover bid by two Brazilian firms, ISS said in an analysis on Friday. Chiquita rejected the $625 million offer from orange juice behemoth Cutrale Group and investment bank Safra Group last month, and reaffirmed its plan to create the world’s largest banana company by merging with Fyffes. The combined company, dubbed ChiquitaFyffes PLC, would be headquartered in low-tax Ireland. Charlotte, N.C.-based Chiquita could face boycotts over its plan to split to Ireland in the so-called tax inversion deal. Tax inversions occur when a larger American company merges with a smaller foreign firm and moves overseas to skirt U.S. corporate taxes, which are among the highest in the world. The tactic, which has become increasingly popular over the last year, is facing intense political backlash as several high-ranking senators and the White House are exploring legal options to make inversions more difficult.

No comments:

Post a Comment