US consumer sentiment unexpectedly falls in November - Reuters through CNBC - November 8, 2013 - .S. consumer sentiment unexpectedly dipped in November to a near two-year low as lower-income households worried about their job prospects and financial outlooks and negative views of the government lingered, a survey released on Friday showed. The Thomson Reuters/University of Michigan's preliminary reading on the overall index of consumer sentiment fell to 72.0 in November, its lowest since December 2011. That was lower than both October's final reading of 73.2 and the 74.5 economists had expected this month. Lower-income households in particular worried about their future financial state. That was a contrast to richer households—those with incomes above $75,000—which felt more optimistic as stock prices increases boosted net wealth gains.

US Rents Rise To New All-Time High; Homeownership Rate Stuck At 18 Year Low - Zero Hedge - Tyler Durden - November 5, 2013 - One quarter ago, when we performed our regular update on trends in US homeownership and rents, we said that "The American Homeownership Dream is officially dead. Long live the New Normal American Dream: Renting." What happened since then is that the American Dream briefly became a full-blown nightmare when in Q3 mortgage rates exploded, pummeling the affordability of housing, and ground any new mortgage-funded transactions to a complete halt (don't believe us - just ask the tens of thousands of mortgage brokers let go by the TBTF banks in the past 6 months). Which is why it was not at all surprising to find that the just updated Q3 homeownership rate has remained stuck at 65.1%: the lowest since 1995.

How

Federal Reserve and banking policy is accelerating income disparity:

Financial obligations ratio soars for renters while declining for

homeowners. Problem is, we have less homeowners.

- Dr. Housing Bubble

How China Can Cause The Death Of The Dollar And The Entire U.S. Financial System - The Economic Collapse Blog -Michael Snyder - November 7th, 2013 -

The death of the dollar is coming, and it will probably be China that

pulls the trigger. What you are about to read is understood by only a

very small fraction of all Americans. Right now, the U.S. dollar is the

de facto reserve currency of the planet. Most global trade is

conducted in U.S. dollars, and almost all oil is sold for U.S. dollars. More than 60 percent

of all global foreign exchange reserves are held in U.S. dollars, and

far more U.S. dollars are actually used outside of the United States

than inside of it. As will be described below, this has given the

United States some tremendous economic advantages, and most Americans

have no idea how much their current standard of living depends on the

dollar remaining the reserve currency of the world. Unfortunately,

thanks to reckless money printing by the Federal Reserve and the

reckless accumulation of debt by the federal government, the status of

the dollar as the reserve currency of the world is now in great

jeopardy. As I mentioned above, nations all over the globe use U.S. dollars to

trade with one another. This has created tremendous demand for U.S.

dollars and has kept the value of the dollar up. It also means that

Americans can import things that they need much more inexpensively than

they otherwise would be able to. The largest exporting nations such as Saudi Arabia (oil) and China

(cheap plastic trinkets at Wal-Mart) end up with massive piles of U.S.

dollars... But it wouldn't be just the federal government that would suffer.

Just consider what higher rates would do to the real estate market.

About a year ago, the rate on 30 year mortgages was sitting at 3.31

percent. The monthly payment on a 30 year, $300,000 mortgage at that

rate is $1315.52. If the 30 year rate rises to 8 percent, the monthly payment on a 30 year, $300,000 mortgage would be $2201.29. Does 8 percent sound crazy to you? It shouldn't. 8 percent was considered to be normal back in the year 2000. Are you starting to get the picture?

Which America Do You Live In? – 21 Hard To Believe Facts About “Wealthy America” And “Poor America” - The Economic Collapse Blog - Michael Snyder, on November 6th, 2013

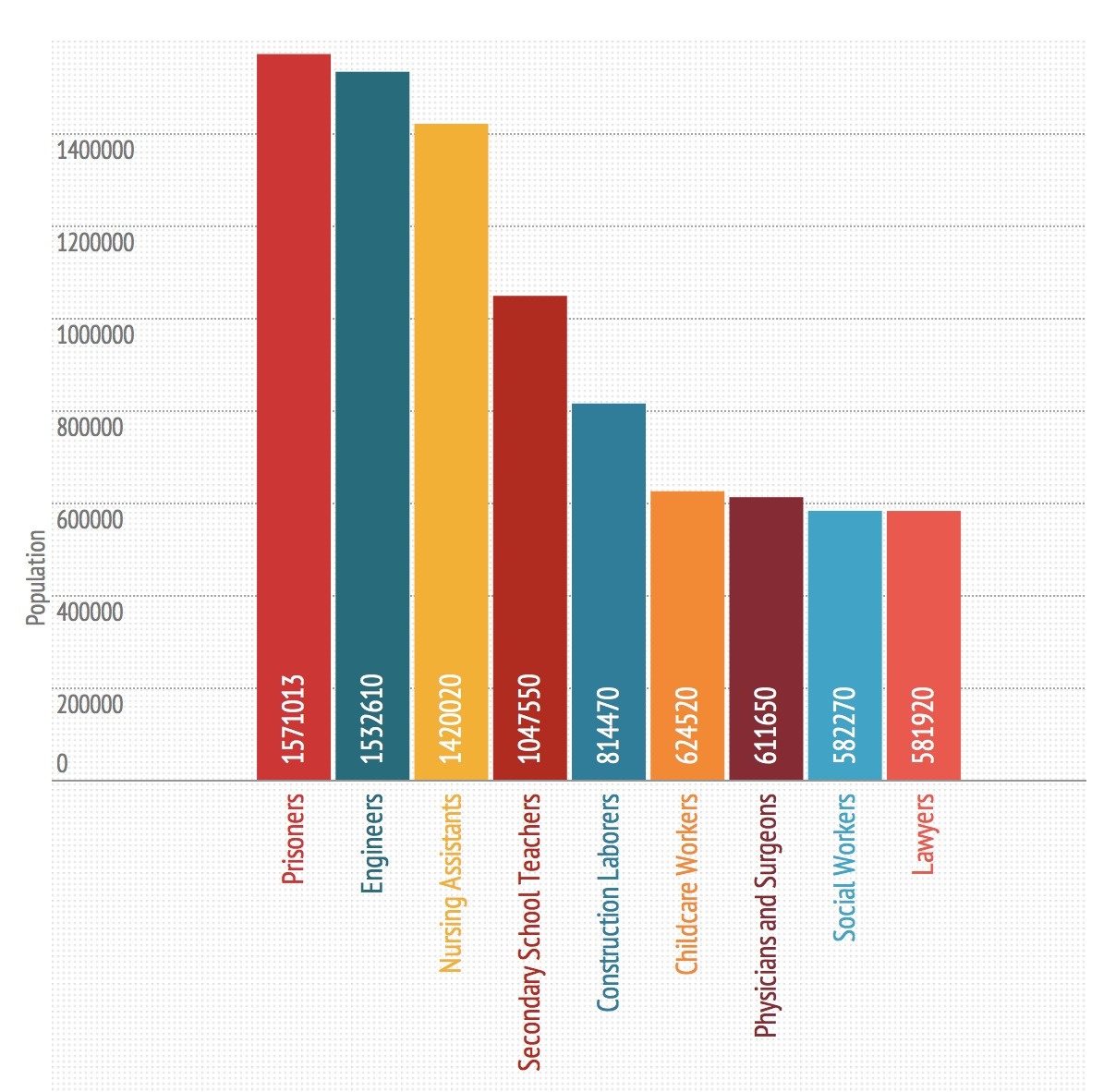

The United States has More People in Jail than High School Teachers and Engineers - A Lightning War for Liberty - November 8, 2013 - America has become a gigantic gulag over the past few decades and most of its citizens don’t know, or just don’t care. One of the primary causes of the over incarceration in the U.S. is the absurd, tragic failure that is the “war on drugs”, and indeed nearly half of the folks in prison are there for drug related offenses. Making matters worse is a rapidly growing private prison system, which adds a profit motive to the equation. Recently, I wrote an extensive rant against the private prison system and provided details on how it works in: A Deep Look into the Shady World of the Private Prison Industry. Now here are some of the sad facts. There are 1.57 million people in federal and state prison (does not even include county and local jail) according to the Department of Justice. That’s above the nation’s 1.53 million engineers and 1.05 million high school teachers.

America Has More Prisoners Than High School Teachers - Huffington Post - Saki Knafo - November 5, 2013

How America Was Lost — Paul Craig Roberts - November 7, 2013 - It is totally and completely obvious that the wars have nothing to do with protecting Americans from terrorism. If anything, the wars stir up and create terrorists. The wars create hatred of America that never previously existed. Despite this, America is free of terrorists attacks except for the ones orchestrated by the FBI. What the fabricated “terror threat” has done is to create a thorough-going domestic police state that is unaccountable. Americans need to understand that they have lost their country. The rest of the world needs to recognize that Washington is not merely the most complete police state since Stalinism, but also a threat to the entire world. The hubris and arrogance of Washington, combined with Washington’s huge supply of weapons of mass destruction, make Washington the greatest threat that has ever existed to all life on the planet. Washington is the enemy of all humanity.

Catherine Austin Fitts Interview about current Economic Circumstances

Catherine Austin Fitts (Wikipedia) - is the president of Solari, Inc., the publisher of The Solari Report, managing member of Solari Investment Advisory Services, LLC., and managing member of Sea Lane Advisory Services, LLC.

Catherine Fitts is a reoccurring guest on the overnight radio program Coast to Coast AM.[1]

|

|

| Join To Get Blog Update Notices |

| Visit the Hickory Hound Group |

Sunday, November 10, 2013

Subscribe to:

Post Comments (Atom)

1 comment:

Thanks for introducing me to Catherine Austin Fitts. Everyone is looking for simple answers to our problems (put those bankers in jail!)but she is pointing out that the situation is not only more complex than we know, but we are a part of the problem. If there is a banker or company that is destroying our system, don't deal with them, withdraw from them, don't give them your information or attention. Admit that our comfortable, middle-class life is based to a certain extent upon our country's willingness to bomb entire countries into rubble and speak out against this. Most of all, change your mind-set and don't be consumed by your anger.

Post a Comment